Question: 2. Suppose a company borrows $1 million debt to invest in a project that generates uncertain cash flow (revenue) of 0~$2 million. The debt has

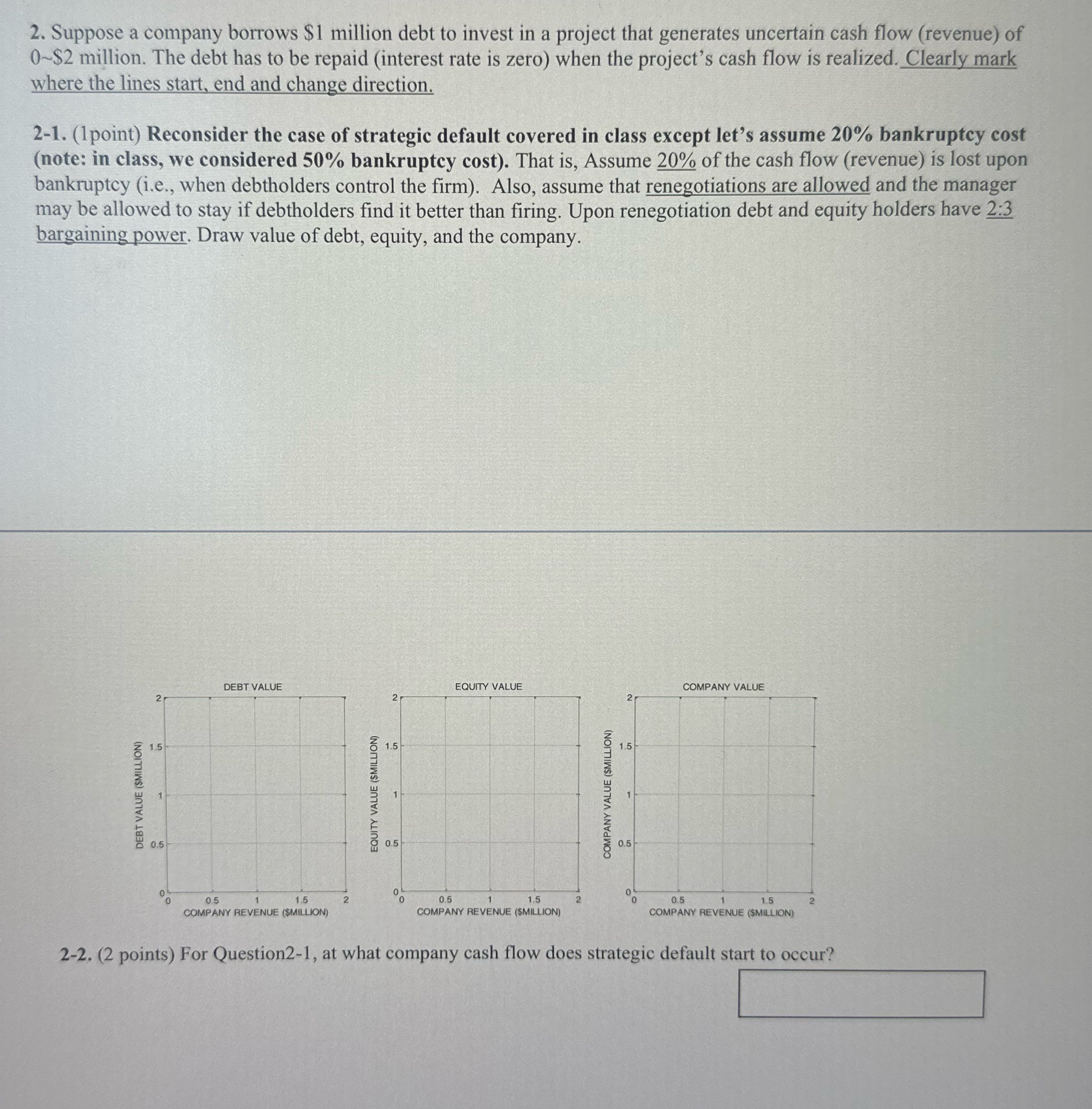

2. Suppose a company borrows $1 million debt to invest in a project that generates uncertain cash flow (revenue) of 0~$2 million. The debt has to be repaid (interest rate is zero) when the project's cash flow is realized. Clearly mark where the lines start, end and change direction. 2-1. (1point) Reconsider the case of strategic default covered in class except let's assume 20% bankruptcy cost (note: in class, we considered 50% bankruptcy cost). That is, Assume 20% of the cash flow (revenue) is lost upon bankruptcy (i.e., when debtholders control the firm). Also, assume that renegotiations are allowed and the manager may be allowed to stay if debtholders find it better than firing. Upon renegotiation debt and equity holders have 2:3 bargaining power. Draw value of debt, equity, and the company. DEBT VALUE EQUITY VALUE COMPANY VALUE 5 1.5 $ 1.5 1.5 COMPANY VALUE ($MILLION EQUITY VALUE (SMILLION DEBT VALUE (SMILLION) 0.5 10.5 0.5 0.5 o 0.5 0.5 COMPANY REVENUE (SMILLION) COMPANY REVENUE (SMILLION) COMPANY REVENUE (SMILLION) 2-2. (2 points) For Question2-1, at what company cash flow does strategic default start to occur

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts