Question: Question 3 Heroes Corporation is considering two mutually exclusive investment opportunities: Project A and Project B Project A will require a capital outlay of $10

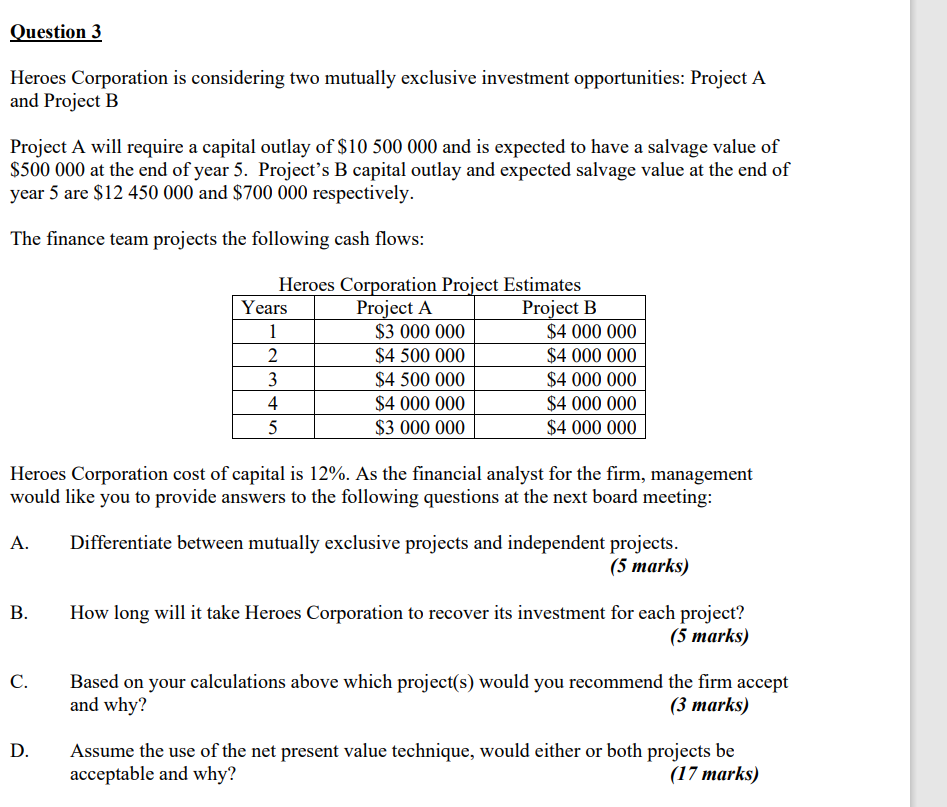

Question 3 Heroes Corporation is considering two mutually exclusive investment opportunities: Project A and Project B Project A will require a capital outlay of $10 500 000 and 1s expected to have a salvage value of $500 000 at the end of year 5. Project's B capital outlay and expected salvage value at the end of year 5 are $12 450 000 and $700 000 respectively. The finance team projects the following cash flows: Heroes Corporation Project Estimates Years Project A Project B $4 500 000 $4 000 000 $4 000 000 $4 000 000 $3 000 000 $4 000 000 [ Lo ko | Heroes Corporation cost of capital is 12%. As the financial analyst for the firm, management would like you to provide answers to the following questions at the next board meeting: A. Differentiate between mutually exclusive projects and independent projects. (5 marks) B. How long will it take Heroes Corporation to recover its investment for each project? (5 marks) B4 Based on your calculations above which project(s) would you recommend the firm accept and why? (3 marks) D. Assume the use of the net present value technique, would either or both projects be acceptable and why? (17 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts