Question: 1. Tokyo Rubber Corporation is considering two mutually exclusive projects for their future investment. The initial cost outlay associate with Dry Prepreg is RM100,000 and

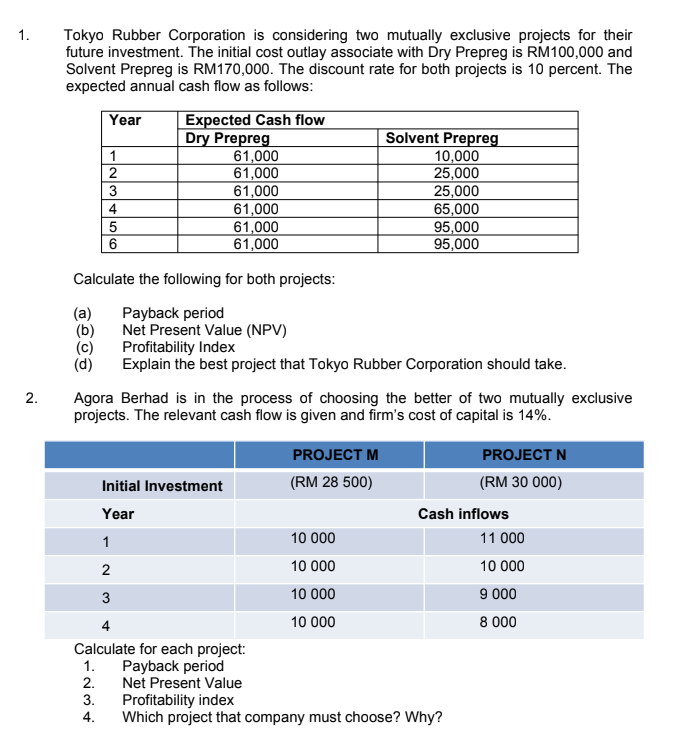

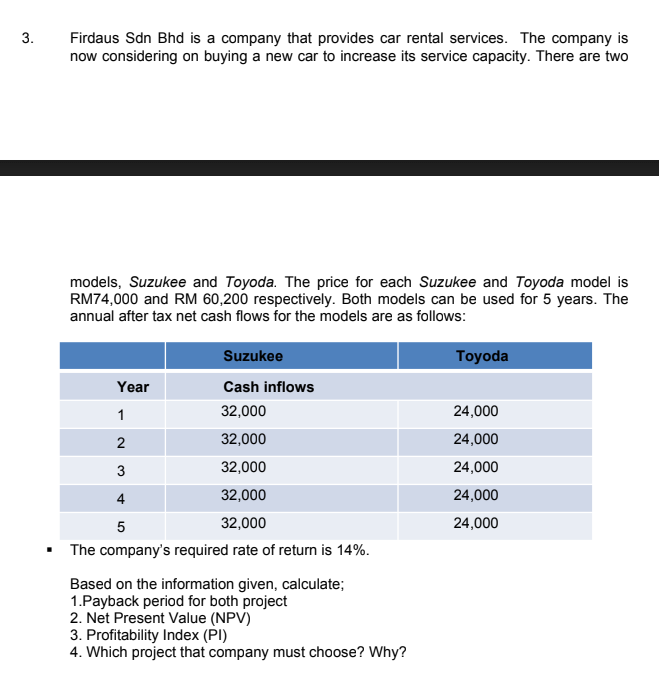

1. Tokyo Rubber Corporation is considering two mutually exclusive projects for their future investment. The initial cost outlay associate with Dry Prepreg is RM100,000 and Solvent Prepreg is RM170,000. The discount rate for both projects is 10 percent. The expected annual cash flow as follows: Year Expected Cash flow Dry Prepreg Solvent Prepreg 1 61,000 10,000 2 61,000 25,000 3 61,000 25,000 61,000 65,000 5 61,000 95,000 6 61,000 95,000 4 Calculate the following for both projects: Payback period Net Present Value (NPV) Profitability Index Explain the best project that Tokyo Rubber Corporation should take. Agora Berhad is in the process of choosing the better of two mutually exclusive projects. The relevant cash flow is given and firm's cost of capital is 14%. 2. PROJECT M PROJECT N Initial Investment (RM 28 500) (RM 30 000) Year Cash inflows 1 10 000 11 000 2 10 000 10 000 3 10 000 9 000 4 10 000 8 000 Calculate for each project: 1. Payback period 2. Net Present Value 3. Profitability index 4. Which project that company must choose? Why? 3. Firdaus Sdn Bhd is a company that provides car rental services. The company is now considering on buying a new car to increase its service capacity. There are two models, Suzukee and Toyoda. The price for each Suzukee and Toyoda model is RM74,000 and RM 60,200 respectively. Both models can be used for 5 years. The annual after tax net cash flows for the models are as follows: Toyoda Suzukee Year Cash inflows 1 32,000 2 32,000 3 32,000 4 32,000 5 32,000 The company's required rate of return is 14%. 24,000 24,000 24,000 24,000 24,000 Based on the information given, calculate; 1.Payback period for both project 2. Net Present Value (NPV) 3. Profitability Index (PI) 4. Which project that company must choose? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts