Question: Question 5 Consider a 5-year coupon government bond. This bond has a 4% coupon rate, a par value of 100 and the coupon payment frequency

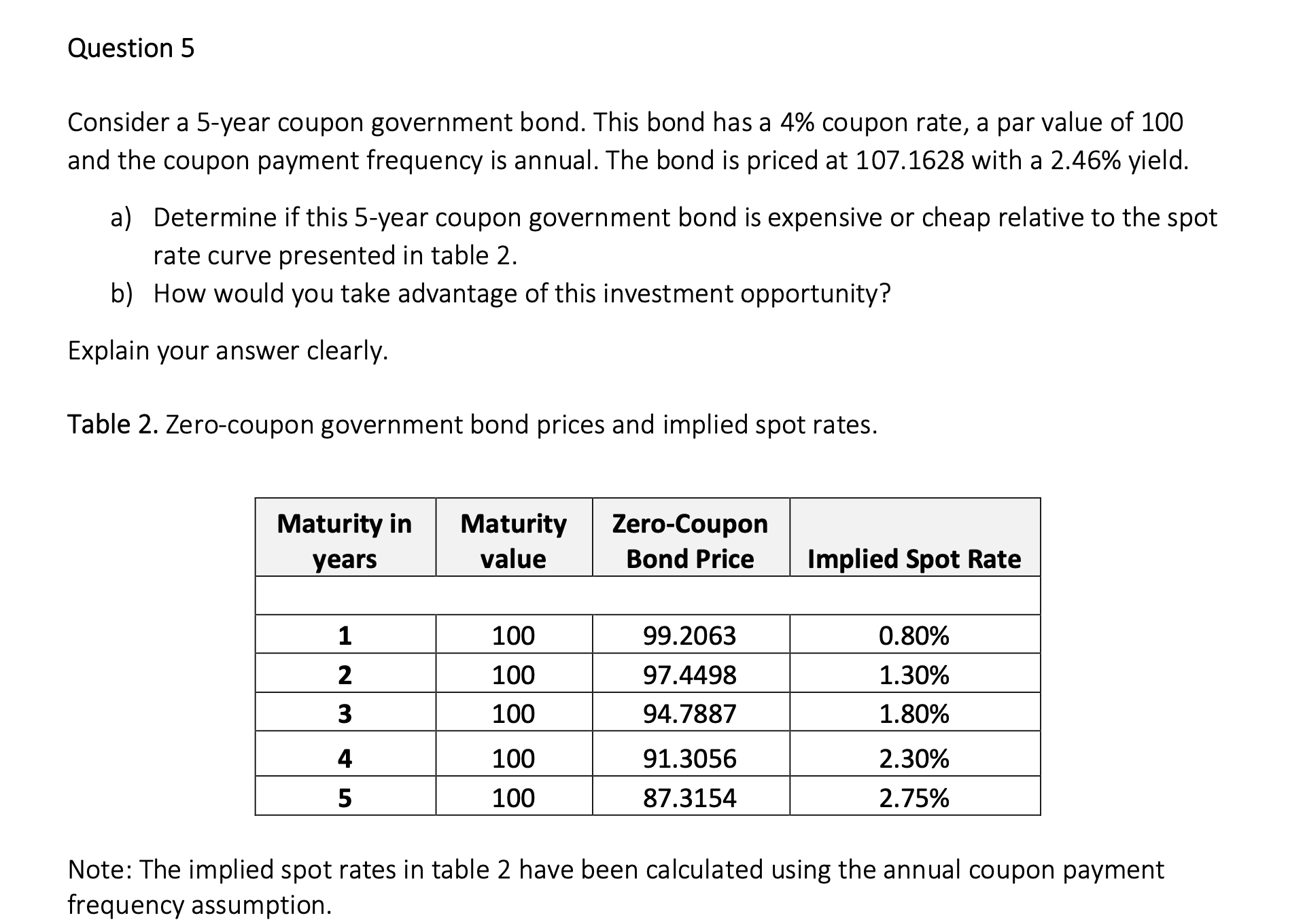

Question 5 Consider a 5-year coupon government bond. This bond has a 4% coupon rate, a par value of 100 and the coupon payment frequency is annual. The bond is priced at 107.1628 with a 2.46% yield. a) Determine if this 5-year coupon government bond is expensive or cheap relative to the spot rate curve presented in table 2. b) How would you take advantage of this investment opportunity? Explain your answer clearly. Table 2. Zero-coupon government bond prices and implied spot rates. Maturity in Maturity | Zero-Coupon years value Bond Price Implied Spot Rate 1 100 99.2063 0.80% 2 100 97.4498 1.30% 3 100 94.7887 1.80% 4 100 91.3056 2.30% 5 100 87.3154 2.75% Note: The implied spot rates in table 2 have been calculated using the annual coupon payment frequency assumption

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts