Question: 4. An investor owns 2,000 shares of ARP Ltd which are currently trading at $9.00 per share. There are put and call options traded on

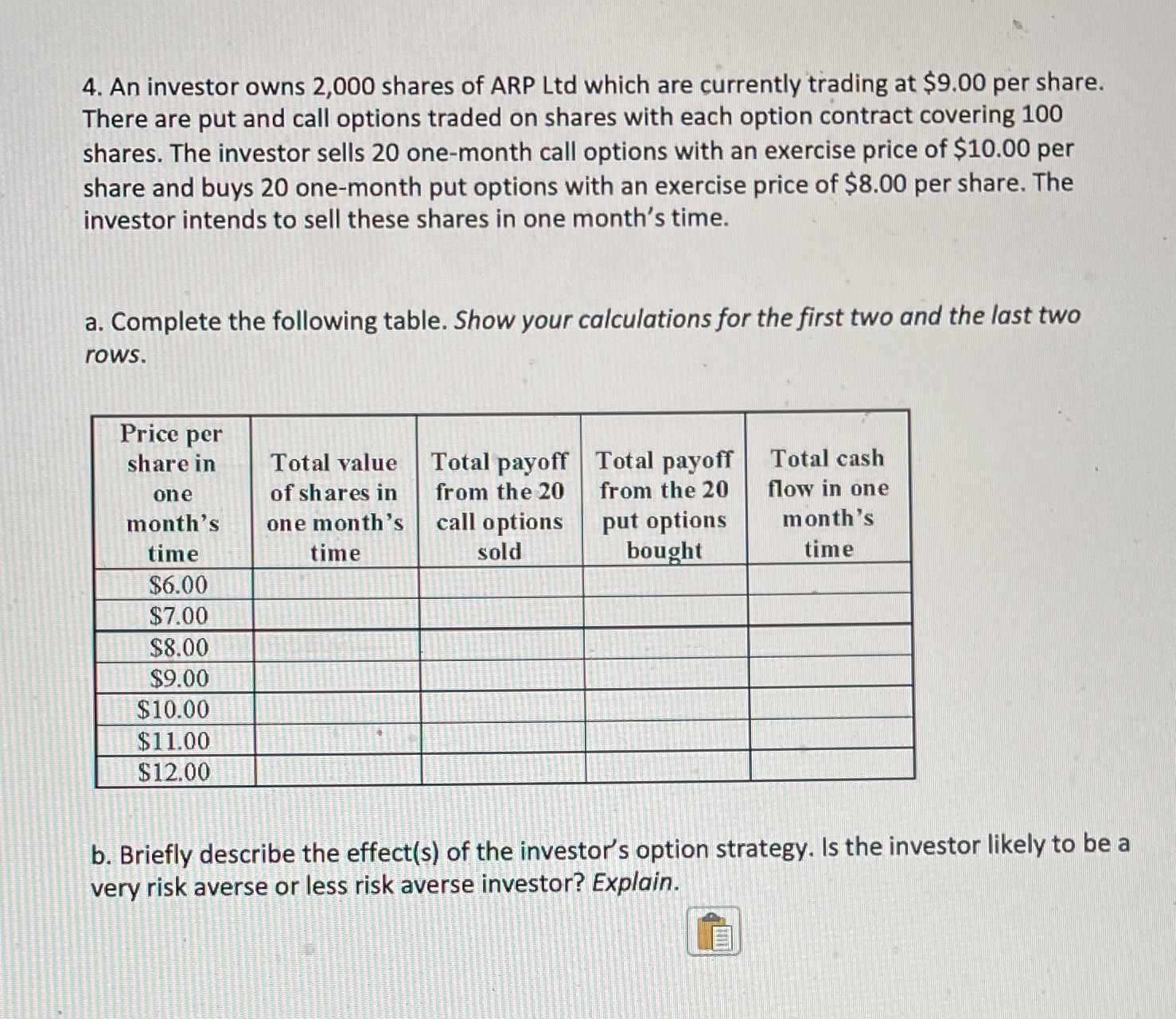

4. An investor owns 2,000 shares of ARP Ltd which are currently trading at $9.00 per share. There are put and call options traded on shares with each option contract covering 100 shares. The investor sells 20 one-month call options with an exercise price of $10.00 per share and buys 20 one-month put options with an exercise price of $8.00 per share. The investor intends to sell these shares in one month's time. a. Complete the following table. Show your calculations for the first two and the last two rows. Price per share in Total value Total payoff Total payoff Total cash one of shares in from the 20 from the 20 flow in one month's one month's call options put options month's time time sold bought time $6.00 $7.00 $8.00 $9.00 $10.00 $11.00 $12.00 b. Briefly describe the effect(s) of the investor's option strategy. Is the investor likely to be a very risk averse or less risk averse investor? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts