Question: Net Realizable Value MethodMultiple Choice: Each of the three multiple-choice exercises should be considered independent of each other. a. The Rote Company manufactures products C

Net Realizable Value Method—Multiple Choice: Each of the three multiple-choice exercises should be considered independent of each other.

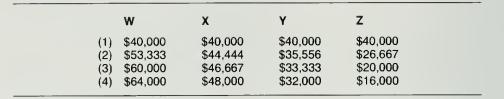

a. The Rote Company manufactures products C and R from a joint process. The total joint costs are $60,000. The sales value at split-off was $75,000 for 8,000 units of product C and $25,000 for 2,000 units of product R. Assuming that total joint costs are allocated using the net realizable value at split-off approach, what were the joint costs allocated to product C?

(1) $15,000.

(2) $30,000.

(3) $45,000.

(4) $48,000.

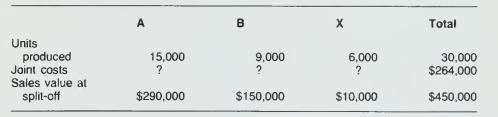

b. Superior Company manufactures products A and B from a joint process, which also yields a by-product, X. Superior accounts for the revenues from its byproduct sales as other income. Additional information is as follows:

Assuming that joint product costs are allocated using the net realizable value at split-off approach, what was the joint cost allocated to product B?

(1) $79,200.

(2) $88,000.

(3) $90,000.

(4) $99,000.

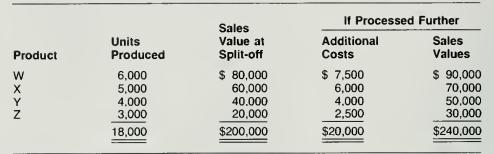

c. Helen Corp. manufactures products W, X, Y. Additional information is as follows:

Assuming that joint total costs of $160,000 were allocated using the net realizable value method, what joint costs were allocated to each product?

Units produced Joint costs Sales value at split-off A B X Total 15,000 9,000 6,000 30,000 ? ? ? $264,000 $290,000 $150,000 $10,000 $450,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts