Question: Edit View Chat Window Help Australia A 10 at 4:54 PM D Question 11 3 pts The current USD/AUD exchange rate is 1.3 AUD for

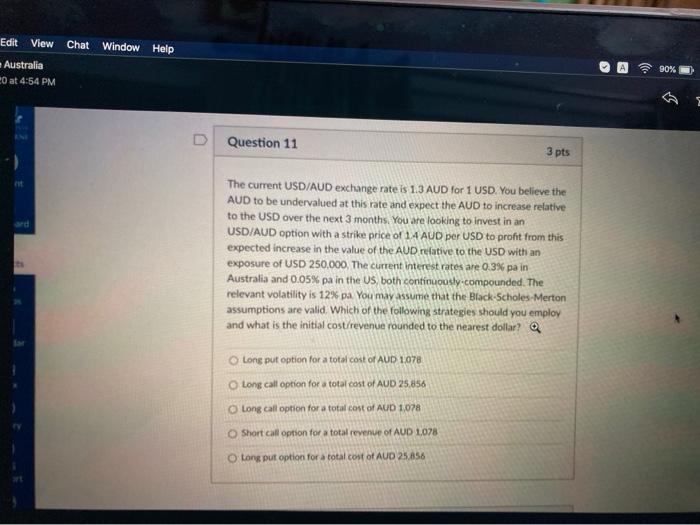

Edit View Chat Window Help Australia A 10 at 4:54 PM D Question 11 3 pts The current USD/AUD exchange rate is 1.3 AUD for 1 USD. You believe the AUD to be undervalued at this rate and expect the AUD to increase relative to the USD over the next 3 months. You are looking to invest in an USD/AUD option with a strike price of 14 AUD per USD to profit from this expected increase in the value of the AUD relative to the USD with an exposure of USD 250.000, The current interest rates are 0.3% pa in Australia and 0.05% pa in the US, both continuously .compounded. The relevant volatility is 12% pa. You may assume that the Black-Scholes-Merton assumptions are valid, Which of the following strategies should you employ and what is the initial cost/revenue rounded to the nearest dollar? @ O Long put option for a total cost of AUD 1:078 Long call option for a total cost of AUD 25,856 Long call option for a total cost of AUD 1,078 Short call option for a total revenue of AUD 1,078 Long put option for a total cost of AUD 25,858

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts