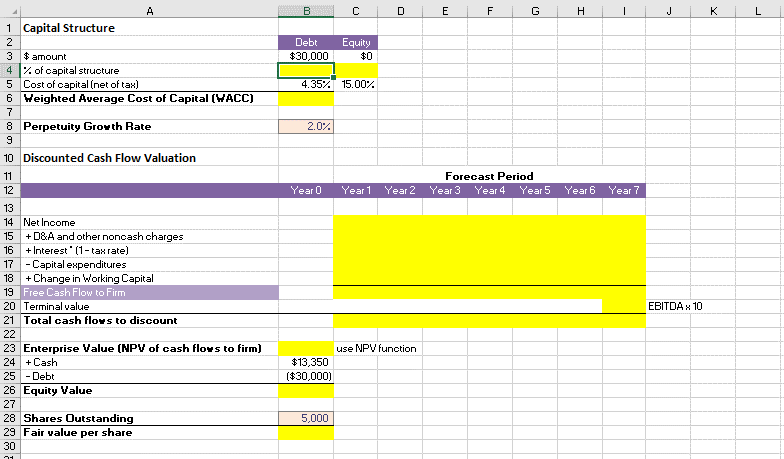

Question: A B C E F G H J K L 1 Capital Structure N Debt Equity $ amount $30,000 $0 4 X of capital structure

A B C E F G H J K L 1 Capital Structure N Debt Equity $ amount $30,000 $0 4 X of capital structure 5 Cost of capital (net of tax) 4.35% 15.00% 6 Weighted Average Cost of Capital (WACC] -J 8 Perpetuity Growth Rate 2.0% LO 10 Discounted Cash Flow Valuation 11 Forecast Period 12 Year 0 Year1 Year2 Year 3 Year4 Year5 Year6 Year 7 13 14 Net Income 15 + D&A and other noncash charges 16 + Interest " (1- tax rate) 17 - Capital expenditures 18 + Change in Working Capital 19 Free Cash Flow to Firm 20 Terminal value EBITDA * 10 21 Total cash flows to discount 22 23 Enterprise Value (NPV of cash flows to firm] use NPV function 24 + Cash $13,350 25 - Debt ($30,000) 26 Equity Value 27 28 Shares Outstanding 5,000 29 Fair value per share 30

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts