Question: Question 3.3 -5 marks ABC can borrow at either a fixed rate of 11% or a floating rate of LIBOR + 1% XYZ can borrow

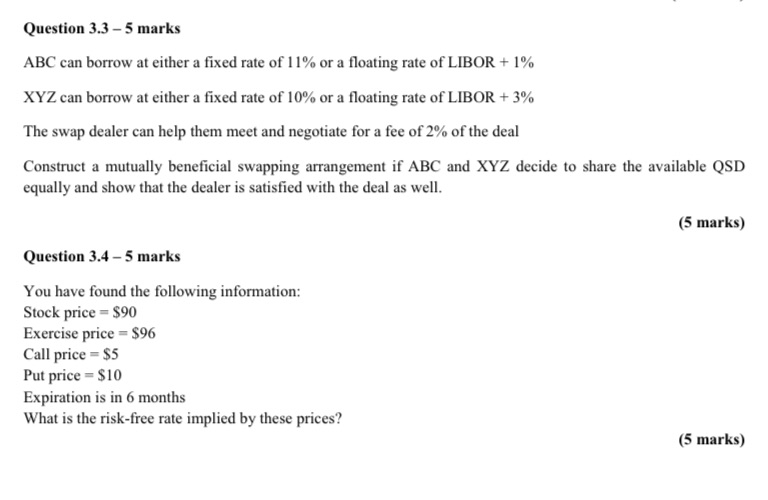

Question 3.3 -5 marks ABC can borrow at either a fixed rate of 11% or a floating rate of LIBOR + 1% XYZ can borrow at either a fixed rate of 10% or a floating rate of LIBOR + 3% The swap dealer can help them meet and negotiate for a fee of 2% of the deal Construct a mutually beneficial swapping arrangement if ABC and XYZ decide to share the available QSD equally and show that the dealer is satisfied with the deal as well. (5 marks) Question 3.4 -5 marks You have found the following information: Stock price = $90 Exercise price = $96 Call price = $5 Put price = $10 Expiration is in 6 months What is the risk-free rate implied by these prices

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts