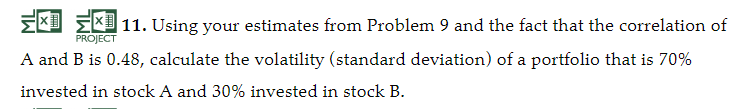

Question: _I _I Z. Z. 11. Using your esmates from Problem 9 and the fact that the correlation of PROJECT 31 and B is [1.48, calculate

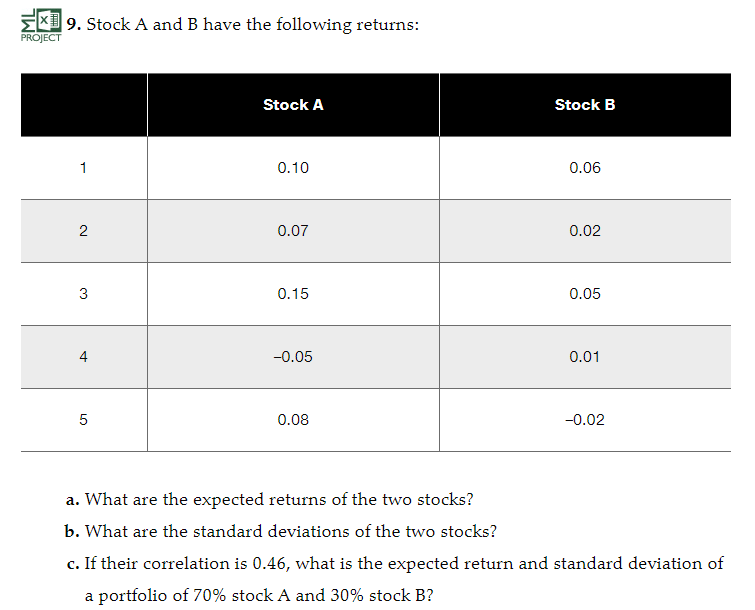

_I _I Z. Z. 11. Using your esmates from Problem 9 and the fact that the correlation of PROJECT 31 and B is [1.48, calculate the volatility (standard deviation) of a portfolio that is T'l' invested in stock A and SEW: invested in stock B. _I E. 9. Stock A and B have the foouring returns: PROJECT Stock A Stock B In. BLUE 2 13.0? CLUE 3 13.15 {1.05 4 43.135 0.131 E DDS U.2 a. What are the expected returns of the two stocks? b. What are the standard deviations of the two stocks? c. If their correlation is [1.46, what is the expected return and standard deviation of a portfolio of TWE stock A and 33% stock B

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts