Question: Securities Selection for Arnold Rimmer Value 19th April VALUE 17th May ASX CODE Name UNITS PRICE VALUE PRICE VALUE PROFIT/LOSS BETA WEIGHT BETA OF A

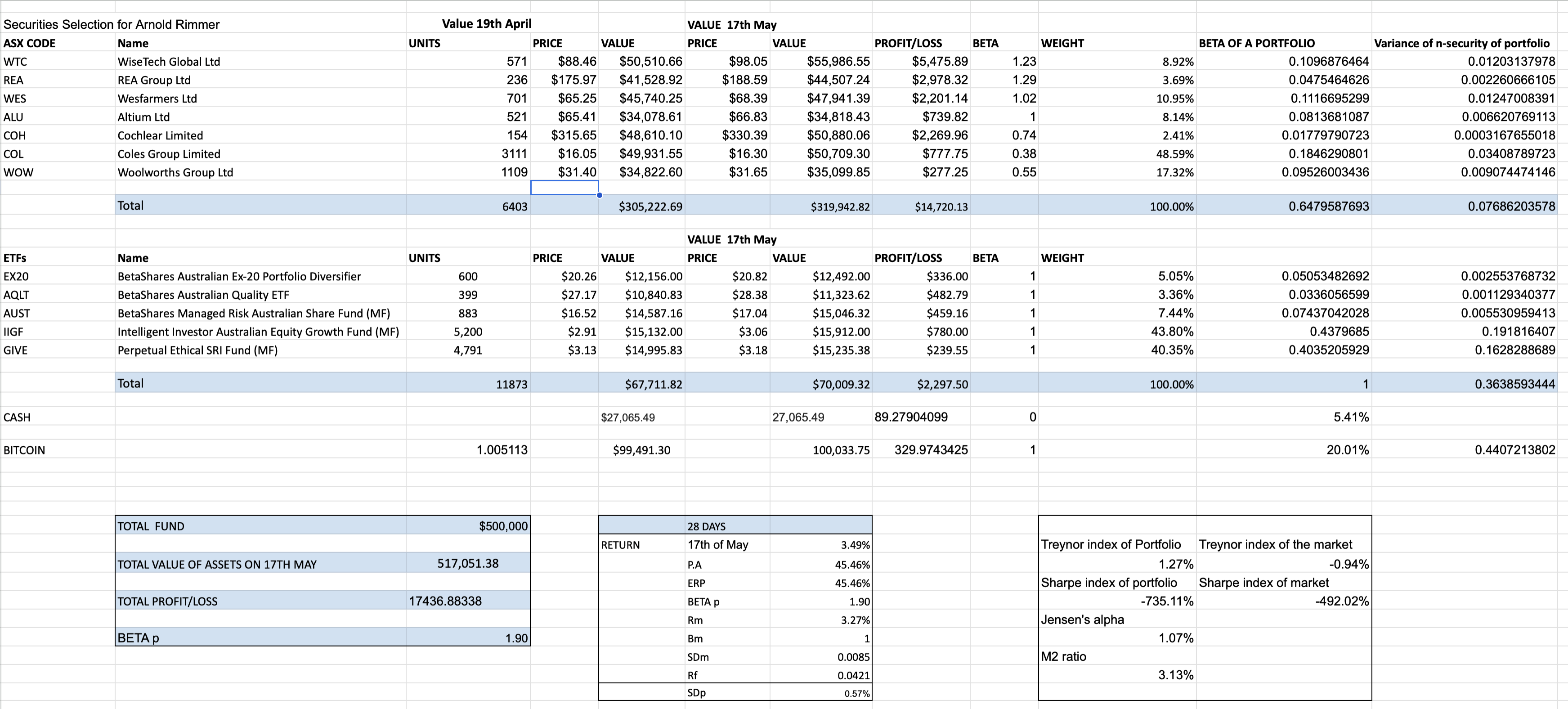

Securities Selection for Arnold Rimmer Value 19th April VALUE 17th May ASX CODE Name UNITS PRICE VALUE PRICE VALUE PROFIT/LOSS BETA WEIGHT BETA OF A PORTFOLIO Variance of n-security of portfolio WTC Wise Tech Global Ltd 571 $88.46 $50,510.66 $98.05 $55,986.55 $5,475.89 1.23 8.92%% 0. 1096876464 0.01203137978 REA REA Group Ltd 236 $175.97 $41,528.92 $188.59 $44,507.24 $2,978.32 1.29 3.69% 0.04754646 0.002260666105 WES Wesfarmers Ltd 701 $65.25 $45,740.25 $68.39 $47,941.39 $2,201.14 1.02 10.95% 0. 1116695299 0.01247008391 ALU Altium Ltd 521 $65.41 $34,078.61 $66.83 $34,818.43 $739.82 8.14% 0.0813681087 0.006620769113 COH Cochlear Limited 154 $315.65 $48,610.10 $330.39 $50,880.06 $2,269.96 0.74 2.41% 0.01779790723 0.0003167655018 COL Coles Group Limited 3111 $16.05 $49,931.55 $16.30 $50,709.30 $777.75 0.38 48.59% 0. 1846290801 0.03408789723 WOW Woolworths Group Ltd 1109 $31.40 $34,822.60 $31.65 $35,099.85 $277.25 0.55 17.32% 0.09526003436 0.009074474146 Total 6403 $305,222.69 $319,942.82 $14,720.13 100.00% 0.6479587693 0.07686203578 VALUE 17th May ETFS Name UNITS PRICE VALUE PRICE VALUE PROFIT/LOSS BETA WEIGHT EX20 BetaShares Australian Ex-20 Portfolio Diversifier 600 $20.26 $12,156.00 $20.82 $12,492.00 $336.00 5.05% 0.05053482692 0.002553768732 AQLT BetaShares Australian Quality ETF 399 $27.17 $10,840.83 $28.38 $11,323.62 $482.79 3.36% 0.0336056599 0.001129340377 AUST BetaShares Managed Risk Australian Share Fund (MF) 883 $16.52 $14,587.16 $17.04 $15,046.32 $459.16 7.44% 0.07437042028 0.005530959413 IIGF Intelligent Investor Australian Equity Growth Fund (MF) 5,200 $2.91 $15,132.00 $3.06 $15,912.00 $780.00 43.80% 0.4379685 0.191816407 GIVE Perpetual Ethical SRI Fund (MF) 4,791 $3.13 $14,995.83 $3.18 $15,235.38 $239.55 40.35% 0.4035205929 0. 1628288689 Total 11873 $67,711.82 $70,009.32 $2,297.50 100.00% 0.3638593444 CASH $27,065.49 27,065.49 89.27904099 O 5.41% BITCOIN 1.005113 $99,491.30 100,033.75 329.9743425 20.01% 0.4407213802 TOTAL FUND $500,000 28 DAYS RETURN 17th of May 3.49% Treynor index of Portfolio Treynor index of the market TOTAL VALUE OF ASSETS ON 17TH MAY 517,051.38 P.A 45.46% 1.27% -0.94% ERP 45.46% Sharpe index of portfolio Sharpe index of market TOTAL PROFIT/LOSS 17436.88338 BETA p 1.90 -735. 11% -492.02% Rm 3.27% Jensen's alpha BETA p 1.90 Bm 1.07% SDm 0.0085 M2 ratio Rf 0.0421 3.13% SDp 0.57%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts