Question: The nance manager of mm has approached you for assistance with the lm's eapital budgeting: process. At your requeSt, she has provided you with the

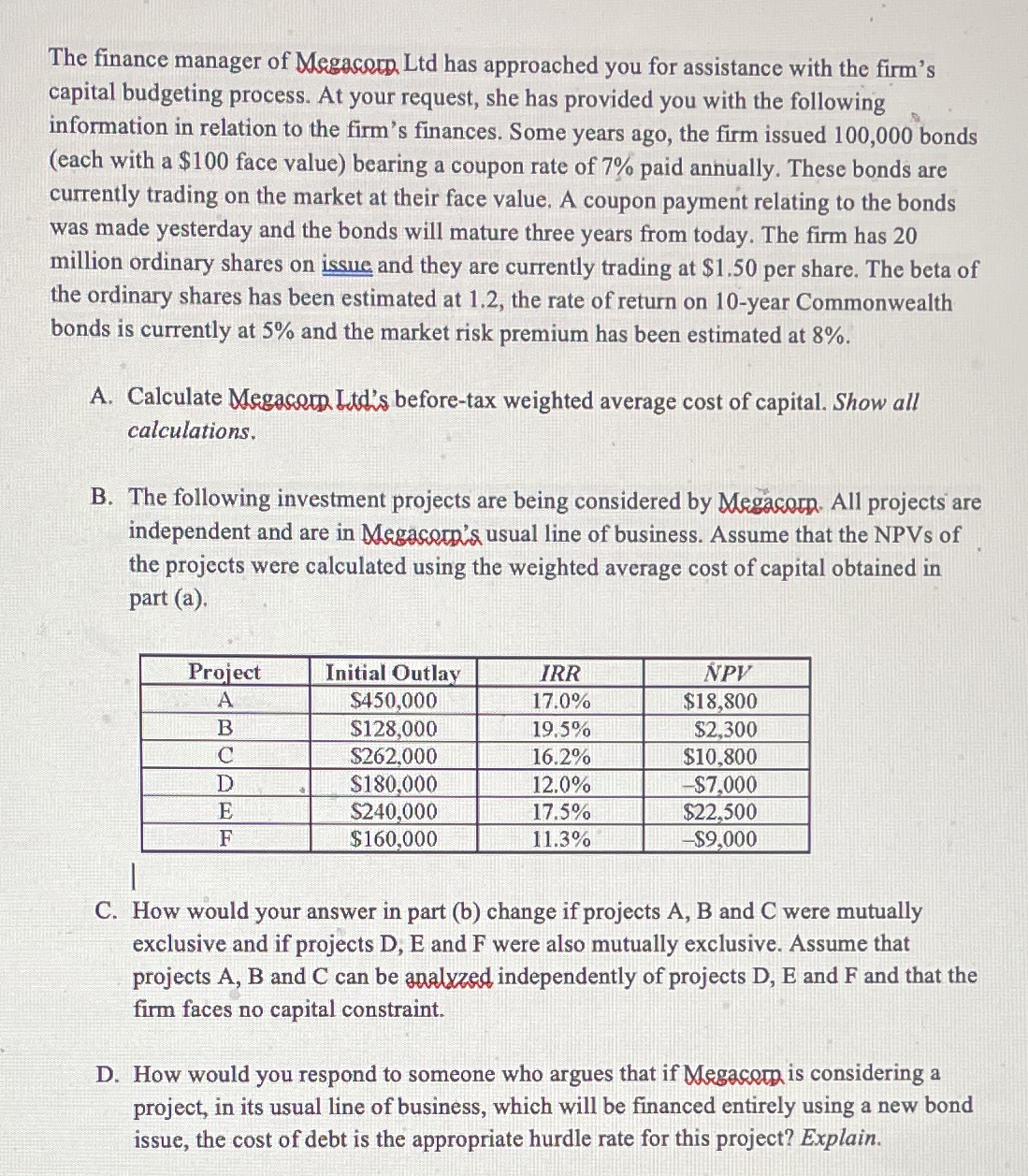

The nance manager of mm has approached you for assistance with the lm's eapital budgeting: process. At your requeSt, she has provided you with the following. . in'fonnation in relation to the rm's furnaces. Some years ago, the rm issued I.00,006honds (each within 3100 face value) bearing a coupon rate of 7% paid annually. 'I'hese bonds are currently trading on the market at their face value. A coupon payment relating to the bonds ' ' was made yesterday and the bonds will mature three years from today. The rm has 20 million ordinary shares on girl, and they are currently trading at $1.50 per share. The beta of the ordinary shares has been estimated at 1.2, the rate of return on Ion-year Commonwealth bonds is currently at 5% and the market risk premium has been estimated at 8%." A. Calculate WWbefore-x Weighted average cost of capital. Show all calculations. B. The following investment projects are being considered by Mm All projects'ate independent and are in Warsaw line of business. Assume that the NPVs of _ the projects were calculated using the weighted average cost of capital obtained in part (a). ' Initial Outlat A "_ l C. How would your mower in part (13) change if projects A, B and C were mutually exclusive and if projects I), E and F were also mutually exclusive. Assume that . projects A, B and C can be Windwendently of projects D, E and F and that the rm faces'no capital constraint- ' D. How would you. respond to someone who argues that if m is considering a project, in its usual line of business, which will be nanced entirely using a new bond issue, the cost of debt is the appropriate hurdle rate for this project? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts