Question: Quantitative Finance I - DFA1232 (1) Question 4 (35 marks) (1) Obtain the Maclaurin's expansion of In (1 + ex) as far as the fourth

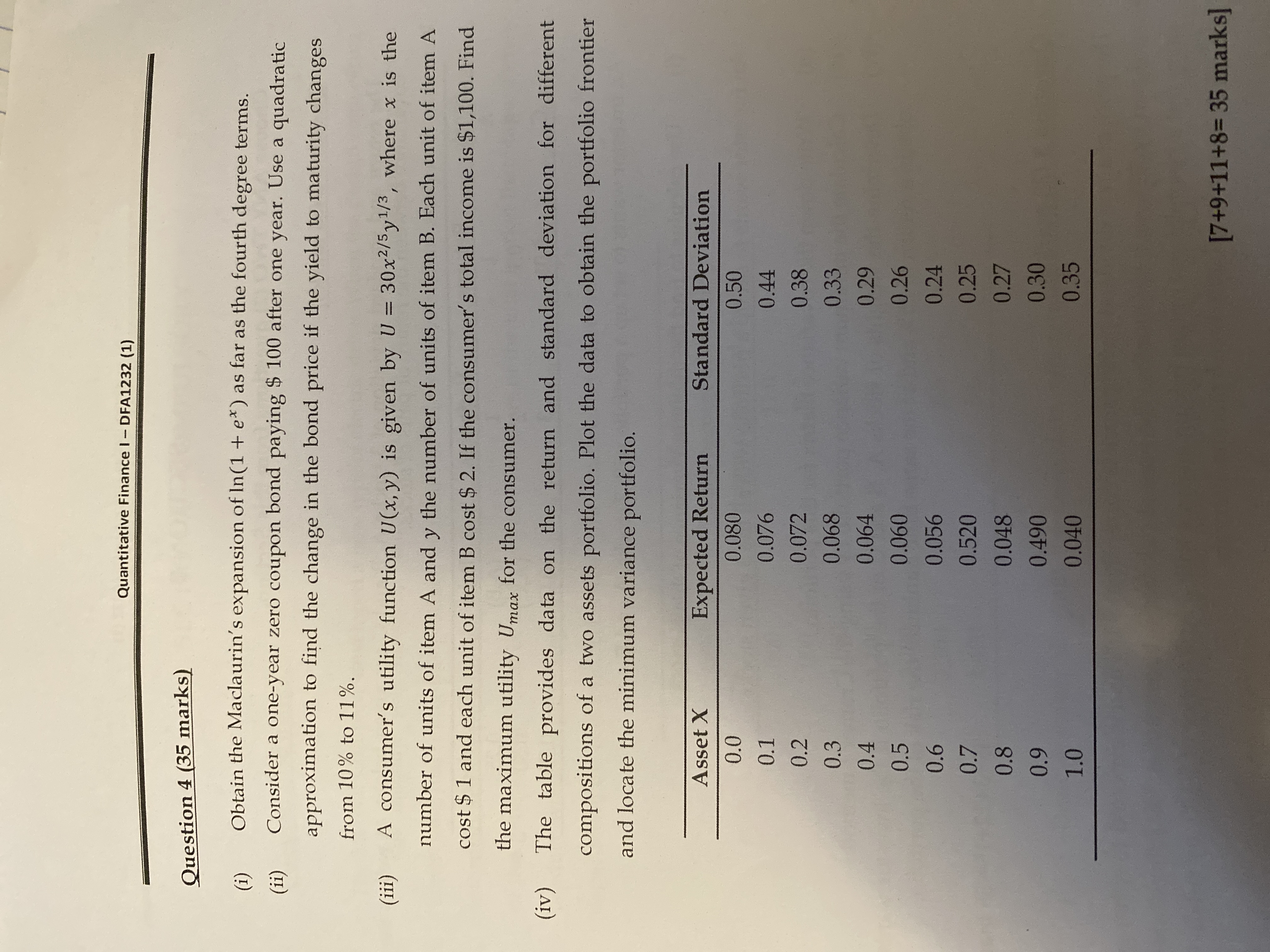

Quantitative Finance I - DFA1232 (1) Question 4 (35 marks) (1) Obtain the Maclaurin's expansion of In (1 + ex) as far as the fourth degree terms. (1i) Consider a one-year zero coupon bond paying $ 100 after one year. Use a quadratic approximation to find the change in the bond price if the yield to maturity changes from 10% to 11%. (iii) A consumer's utility function U(x, y) is given by U = 30x2/5y1/3, where x is the number of units of item A and y the number of units of item B. Each unit of item A cost $ 1 and each unit of item B cost $ 2. If the consumer's total income is $1,100. Find the maximum utility Umax for the consumer. (iv) The table provides data on the return and standard deviation for different compositions of a two assets portfolio. Plot the data to obtain the portfolio frontier and locate the minimum variance portfolio. Asset X Expected Return Standard Deviation 0.0 0.080 0.50 0.1 0.076 0.44 0.2 0.072 0.38 0.3 0.068 0.33 0.4 0.064 0.29 0.5 0.060 0.26 0.6 0.056 0.24 0.7 0.520 0.25 0.8 0.048 0.27 0.9 0.490 0.30 1.0 0.040 0.35 [7+9+11+8= 35 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts