Question: QUESTION TWO The Lusaka Water Sewerage Company (LWSC) is considering two projects to invest in but has limited funds to undertake both projects at once.

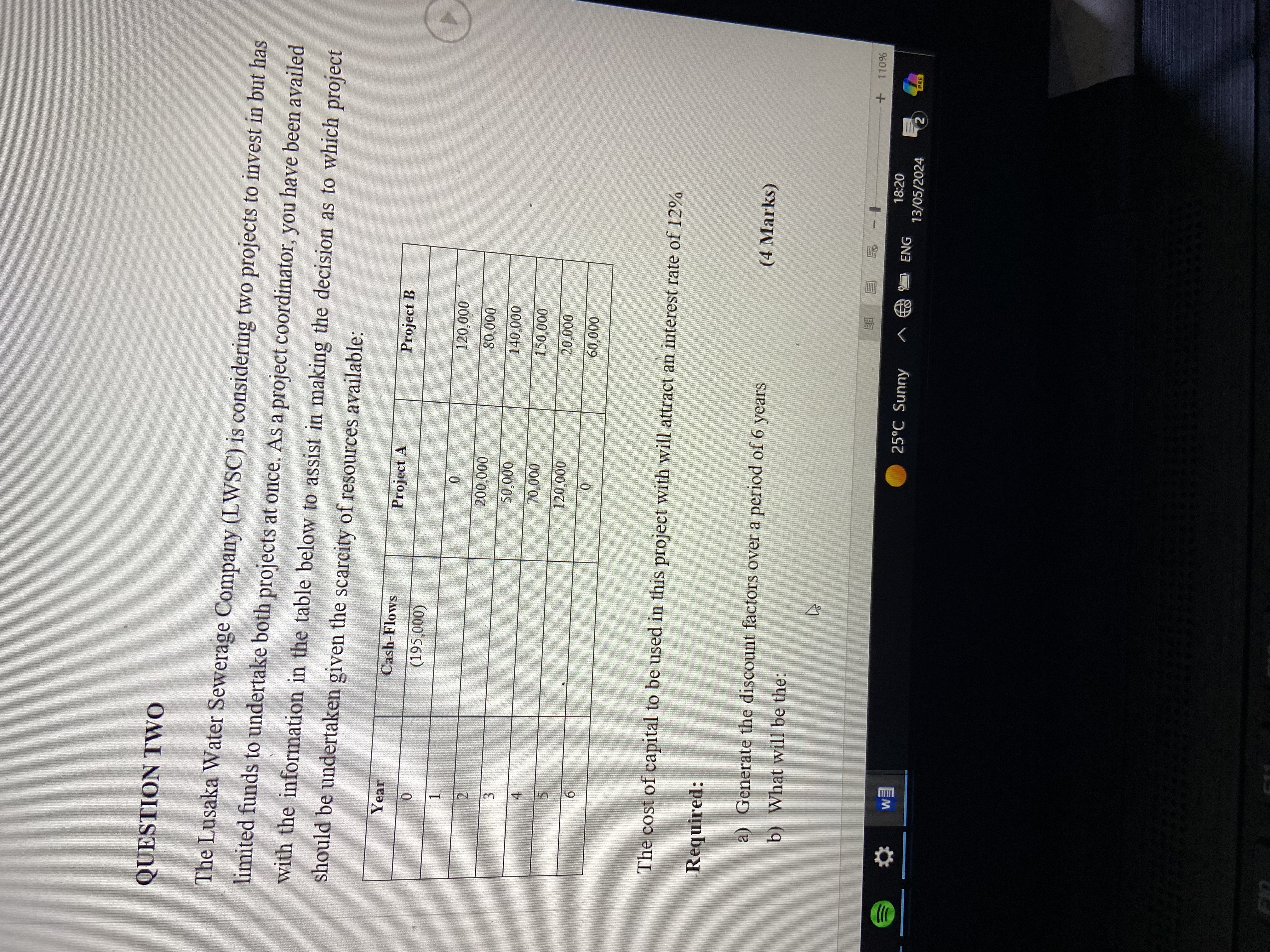

QUESTION TWO The Lusaka Water Sewerage Company (LWSC) is considering two projects to invest in but has limited funds to undertake both projects at once. As a project coordinator, you have been availed with the information in the table below to assist in making the decision as to which project should be undertaken given the scarcity of resources available: Year Cash-Flows Project A Project B 0 (195,000) 1 0 120.000 2 200.000 80.000 50.000 140,000 70,000 150,000 120,000 20,000 0 60.000 The cost of capital to be used in this project with will attract an interest rate of 12% Required: a) Generate the discount factors over a period of 6 years (4 Marks) b) What will be the: + 110% 18:20 WE 25.C Sunny ~ ENG 13/05/2024AFIN 321 PILOT PAI Tools View CTED VIEW Be careful- files from the Internet can contain viruses. Unless you need to edit, it's safer to stay in Protected View. i. Payback period for both projects (4 Marks) ii. The discounted payback period for both projects (4 Marks) 111. The Net Present Values for both projects (6 Marks) Profitability Index for both projects (2 Marks) c) Based on your calculations in (ii) above, which of the two projects should be undertaken and justify your recommendation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts