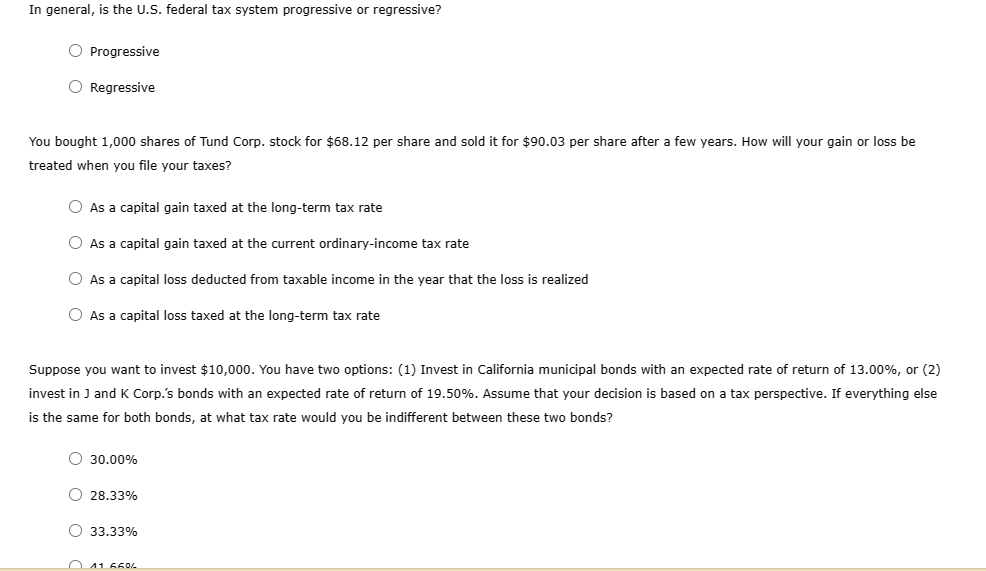

Question: In general, is the U.S. federal tax system progressive or regressive? O Progressive () Regressive You bought 1,000 shares of Tund Corp. stock for $68.12

In general, is the U.S. federal tax system progressive or regressive? O Progressive () Regressive You bought 1,000 shares of Tund Corp. stock for $68.12 per share and sold it for $20.03 per share after a few years. How will your gain or loss be treated when you file your taxes? (O As a capital gain taxed at the long-term tax rate (O As a capital gain taxed at the current ordinary-income tax rate () As a capital loss deducted from taxable income in the year that the loss is realized () As a capital loss taxed at the long-term tax rate Suppose you want to invest $10,000. You have two options: (1) Invest in California municipal bonds with an expected rate of return of 13.00%, or (2) invest in J and K Corp.'s bonds with an expected rate of return of 19.530%. Assume that your decision is based on a tax perspective. If everything else is the same for both bonds, at what tax rate would you be indifferent between these two bonds? O 30.00% O 28.33% O 33.33% A1 &ROL

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts