Question: You are trying to develop a strategy for investing in two different stocks. The anticipated annual return for a $1,000 investment in Probability each stock

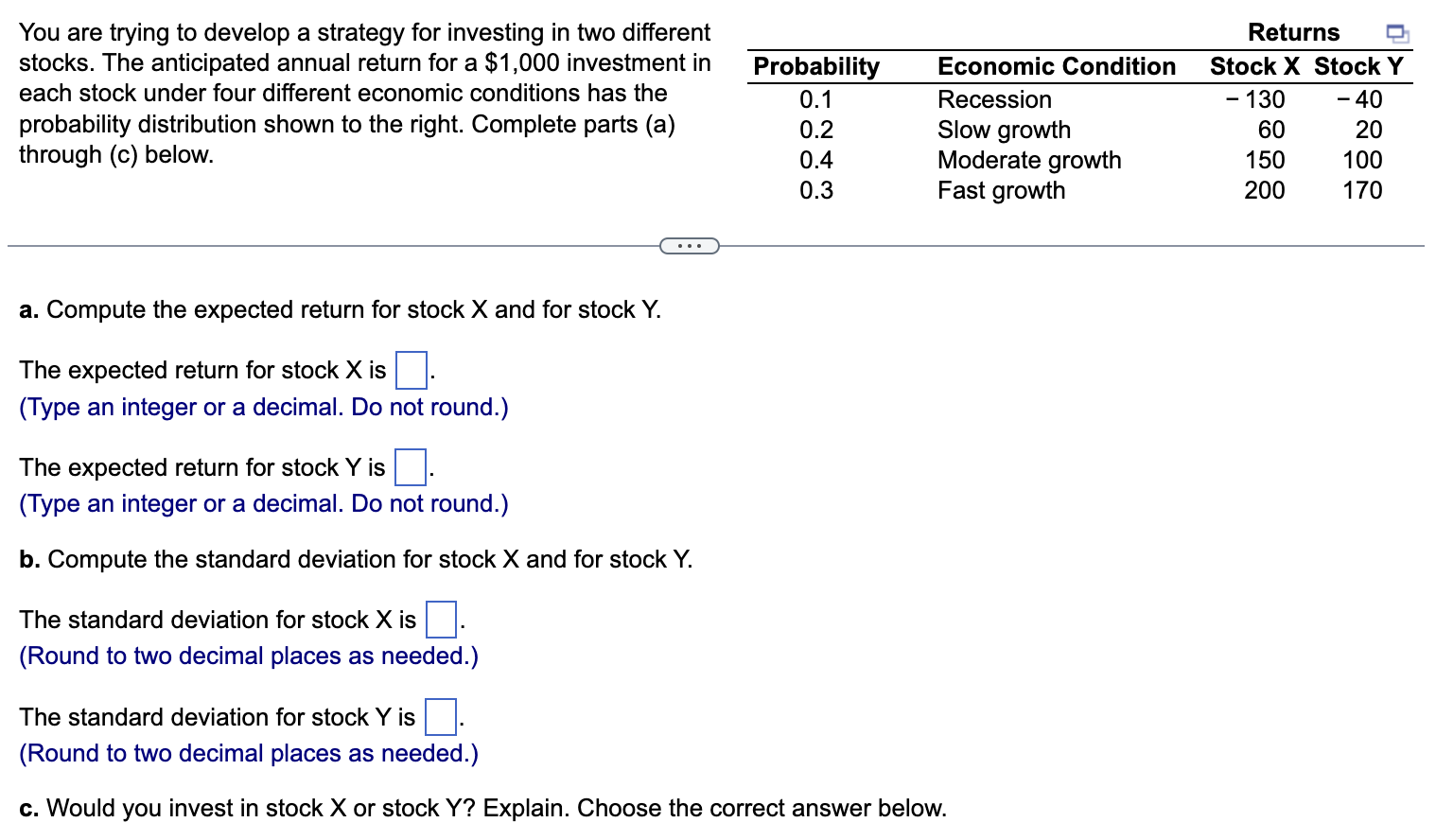

You are trying to develop a strategy for investing in two different stocks. The anticipated annual return for a $1,000 investment in Probability each stock under four different economic conditions has the 0.1 probability distribution shown to the right. Complete parts (a) 0.2 through (c) below. 04 0.3 () a. Compute the expected return for stock X and for stock Y. The expected return for stock X is |:| (Type an integer or a decimal. Do not round.) The expected return for stock Y is |:| (Type an integer or a decimal. Do not round.) b. Compute the standard deviation for stock X and for stock Y. The standard deviation for stock X is |:| (Round to two decimal places as needed.) The standard deviation for stock Y is |:| (Round to two decimal places as needed.) Economic Condition Recession Slow growth Moderate growth Fast growth c. Would you invest in stock X or stock Y? Explain. Choose the correct answer below. Returns o Stock X StockY =130 =40 60 20 150 100 200 170

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts