Question: Question 2 2.5 pts Isabella is looking to purchase an extremely fancy car without having to pay anything up front. On January 1st, Year 1,

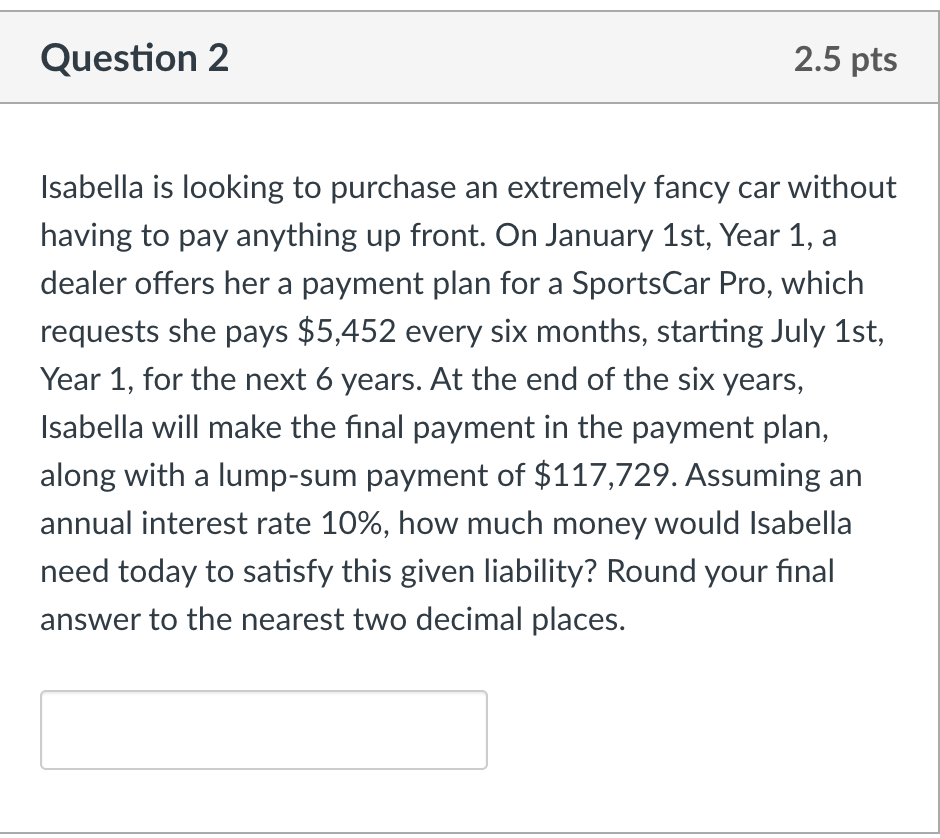

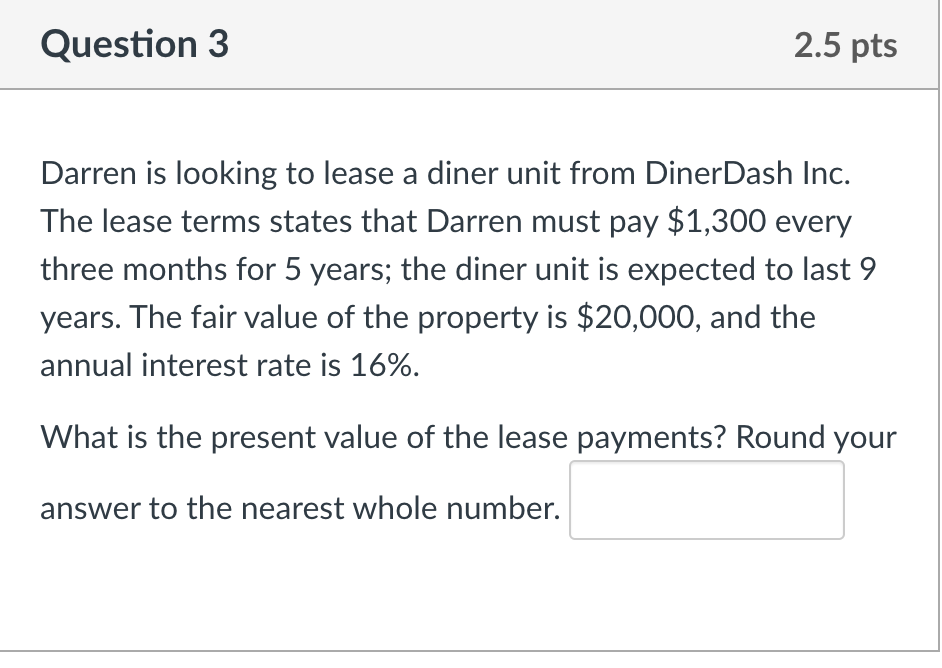

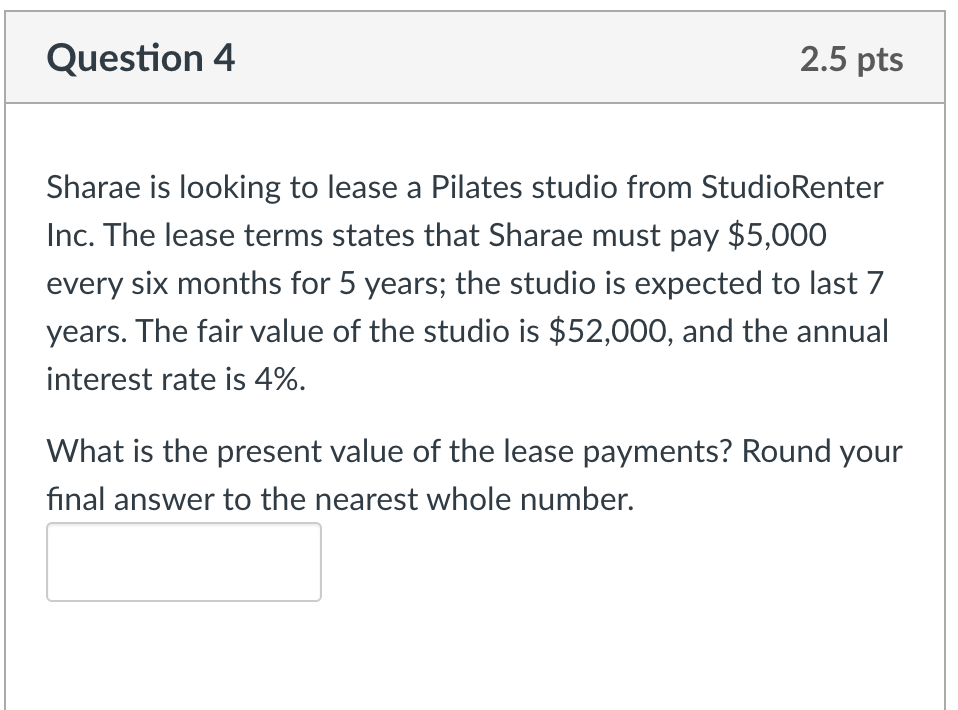

Question 2 2.5 pts Isabella is looking to purchase an extremely fancy car without having to pay anything up front. On January 1st, Year 1, a dealer offers her a payment plan for a SportsCar Pro, which requests she pays $5,452 every six months, starting July 1st, Year 1, for the next 6 years. At the end of the six years, Isabella will make the final payment in the payment plan, along with a lump-sum payment of $117,729. Assuming an annual interest rate 10%, how much money would Isabella need today to satisfy this given liability? Round your final answer to the nearest two decimal places. Question 3 2.5 pts Darren is looking to lease a diner unit from DinerDash Inc. The lease terms states that Darren must pay $1,300 every three months for 5 years; the diner unit is expected to last 9 years. The fair value of the property is $20,000, and the annual interest rate is 16%. What is the present value of the lease payments? Round your answer to the nearest whole number. Sharae is looking to lease a Pilates studio from StudioRenter Inc. The lease terms states that Sharae must pay $5,000 every six months for 5 years; the studio is expected to last 7 years. The fair value of the studio is $52,000, and the annual interest rate is 4%. What is the present value of the lease payments? Round your final answer to the nearest whole number

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts