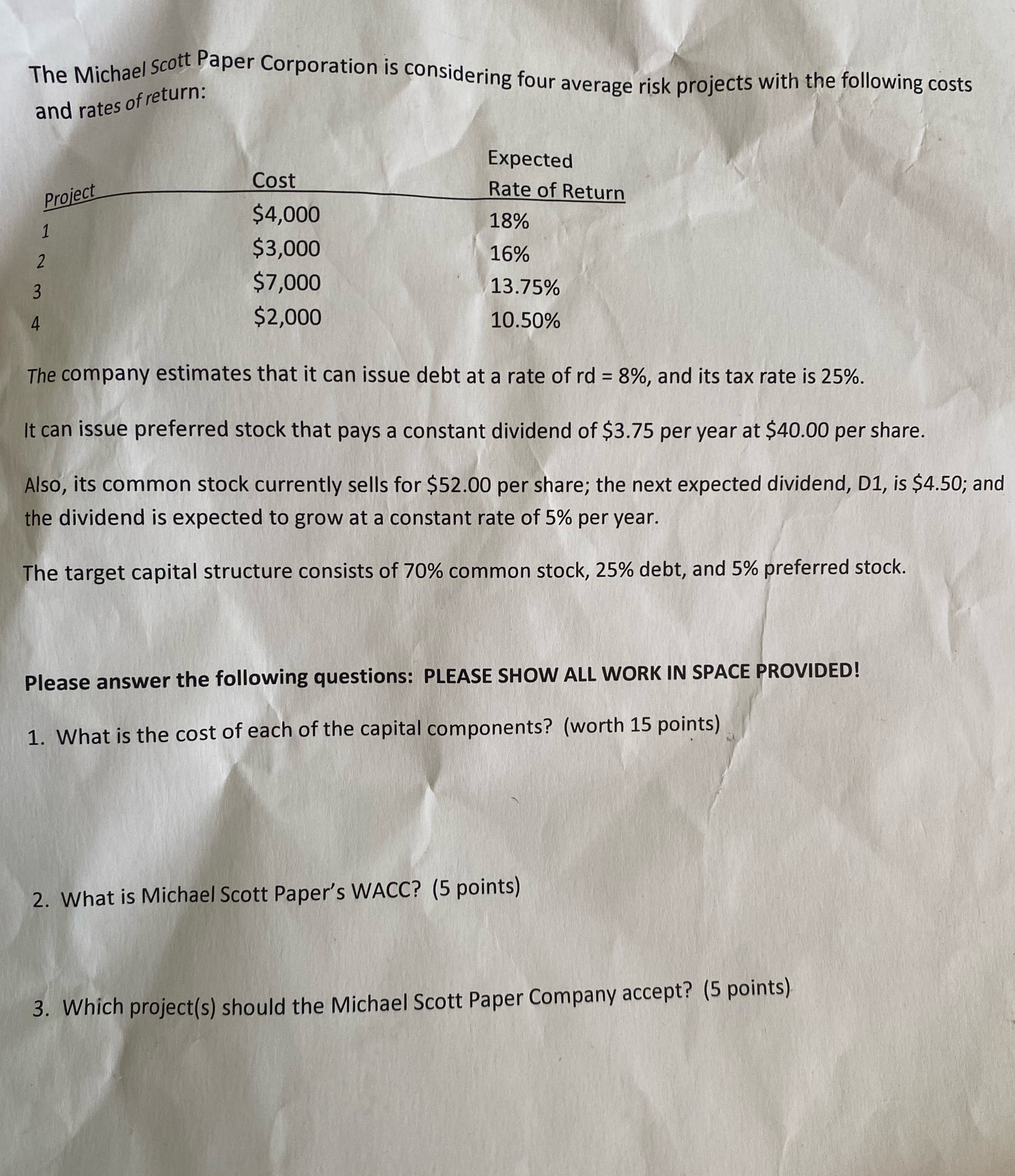

Question: The Michael Scott Paper Corporation is considering four average risk projects with the following costs and rates of return: Expected Cost Project Rate of Return

The Michael Scott Paper Corporation is considering four average risk projects with the following costs and rates of return: Expected Cost Project Rate of Return $4,000 18% $3,000 16% D W N $7,000 13.75% $2,000 10.50% The company estimates that it can issue debt at a rate of rd = 8%, and its tax rate is 25%. It can issue preferred stock that pays a constant dividend of $3.75 per year at $40.00 per share. Also, its common stock currently sells for $52.00 per share; the next expected dividend, D1, is $4.50; and the dividend is expected to grow at a constant rate of 5% per year. The target capital structure consists of 70% common stock, 25% debt, and 5% preferred stock. Please answer the following questions: PLEASE SHOW ALL WORK IN SPACE PROVIDED! 1. What is the cost of each of the capital components? (worth 15 points) 2. What is Michael Scott Paper's WACC? (5 points) 3. Which project(s) should the Michael Scott Paper Company accept? (5 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts