Question: McCollum Company manufactures two products. Both products have the same sales price, and the volume of sales is equivalent. However, due to the difference

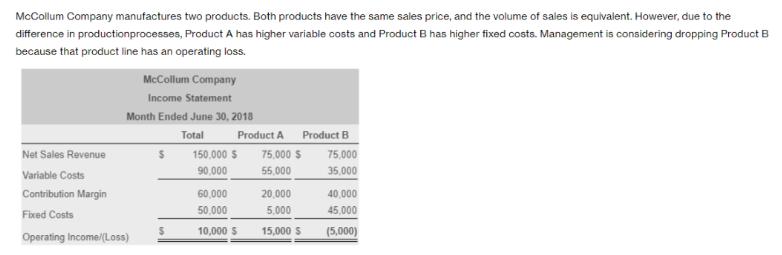

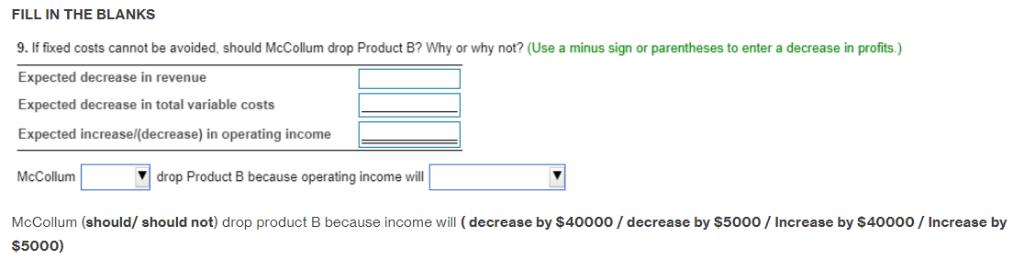

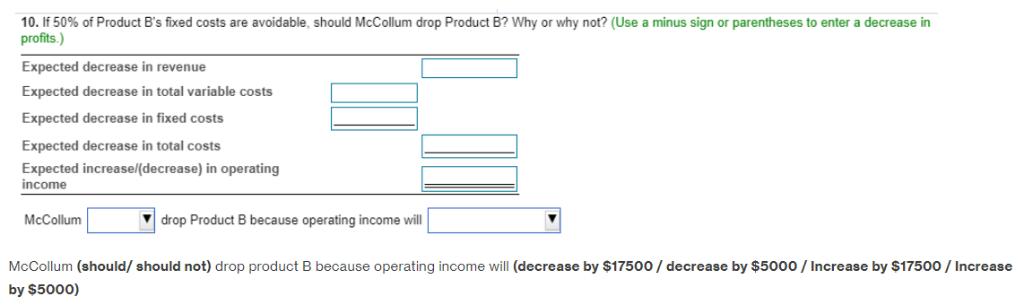

McCollum Company manufactures two products. Both products have the same sales price, and the volume of sales is equivalent. However, due to the difference in productionprocesses, Product A has higher variable costs and Product B has higher fixed costs. Management is considering dropping Product B because that product line has an operating loss. McCollum Company Income Statement Month Ended June 30, 2018 Total Product A Product B Net Sales Revenue 150,000 S 75,000 S 75,000 Variable Costs 90,000 55,000 35,000 Contribution Margin 60,000 20,000 40,000 Fixed Costs 50.000 5,000 45,000 Operating Income/(Loss) 10,000 S 15,000 S (5,000) FILL IN THE BLANKS 9. If fixed costs cannot be avoided, should McCollum drop Product B? Why or why not? (Use a minus sign or parentheses to enter a decrease in profits.) Expected decrease in revenue Expected decrease in total variable costs Expected increase/(decrease) in operating income McCollum V drop Product B because operating income will McCollum (should/ should not) drop product B because income will ( decrease by $40000 / decrease by $5000 / Increase by $40000 / Increase by $5000) 10. If 50% of Product B's fixed costs are avoidable, should McCollum drop Product B? Why or why not? (Use a minus sign or parentheses to enter a decrease in profits.) Expected decrease in revenue Expected decrease in total variable costs Expected decrease in fixed costs Expected decrease in total costs Expected increasel(decrease) in operating income McCollum V drop Product B because operating income will McCollum (should/ should not) drop product B because operating income will (decrease by $17500 / decrease by $5000 / Increase by $17500 / Increase by $5000) McCollum Company manufactures two products. Both products have the same sales price, and the volume of sales is equivalent. However, due to the difference in productionprocesses, Product A has higher variable costs and Product B has higher fixed costs. Management is considering dropping Product B because that product line has an operating loss. McCollum Company Income Statement Month Ended June 30, 2018 Total Product A Product B Net Sales Revenue 150,000 S 75,000 S 75,000 Variable Costs 90,000 55,000 35,000 Contribution Margin 60,000 20,000 40,000 Fixed Costs 50.000 5,000 45,000 Operating Income/(Loss) 10,000 S 15,000 S (5,000) FILL IN THE BLANKS 9. If fixed costs cannot be avoided, should McCollum drop Product B? Why or why not? (Use a minus sign or parentheses to enter a decrease in profits.) Expected decrease in revenue Expected decrease in total variable costs Expected increase/(decrease) in operating income McCollum V drop Product B because operating income will McCollum (should/ should not) drop product B because income will ( decrease by $40000 / decrease by $5000 / Increase by $40000 / Increase by $5000) 10. If 50% of Product B's fixed costs are avoidable, should McCollum drop Product B? Why or why not? (Use a minus sign or parentheses to enter a decrease in profits.) Expected decrease in revenue Expected decrease in total variable costs Expected decrease in fixed costs Expected decrease in total costs Expected increasel(decrease) in operating income McCollum V drop Product B because operating income will McCollum (should/ should not) drop product B because operating income will (decrease by $17500 / decrease by $5000 / Increase by $17500 / Increase by $5000) McCollum Company manufactures two products. Both products have the same sales price, and the volume of sales is equivalent. However, due to the difference in productionprocesses, Product A has higher variable costs and Product B has higher fixed costs. Management is considering dropping Product B because that product line has an operating loss. McCollum Company Income Statement Month Ended June 30, 2018 Total Product A Product B Net Sales Revenue 150,000 S 75,000 S 75,000 Variable Costs 90,000 55,000 35,000 Contribution Margin 60,000 20,000 40,000 Fixed Costs 50.000 5,000 45,000 Operating Income/(Loss) 10,000 S 15,000 S (5,000) FILL IN THE BLANKS 9. If fixed costs cannot be avoided, should McCollum drop Product B? Why or why not? (Use a minus sign or parentheses to enter a decrease in profits.) Expected decrease in revenue Expected decrease in total variable costs Expected increase/(decrease) in operating income McCollum V drop Product B because operating income will McCollum (should/ should not) drop product B because income will ( decrease by $40000 / decrease by $5000 / Increase by $40000 / Increase by $5000) 10. If 50% of Product B's fixed costs are avoidable, should McCollum drop Product B? Why or why not? (Use a minus sign or parentheses to enter a decrease in profits.) Expected decrease in revenue Expected decrease in total variable costs Expected decrease in fixed costs Expected decrease in total costs Expected increasel(decrease) in operating income McCollum V drop Product B because operating income will McCollum (should/ should not) drop product B because operating income will (decrease by $17500 / decrease by $5000 / Increase by $17500 / Increase by $5000) McCollum Company manufactures two products. Both products have the same sales price, and the volume of sales is equivalent. However, due to the difference in productionprocesses, Product A has higher variable costs and Product B has higher fixed costs. Management is considering dropping Product B because that product line has an operating loss. McCollum Company Income Statement Month Ended June 30, 2018 Total Product A Product B Net Sales Revenue 150,000 S 75,000 S 75,000 Variable Costs 90,000 55,000 35,000 Contribution Margin 60,000 20,000 40,000 Fixed Costs 50.000 5,000 45,000 Operating Income/(Loss) 10,000 S 15,000 S (5,000) FILL IN THE BLANKS 9. If fixed costs cannot be avoided, should McCollum drop Product B? Why or why not? (Use a minus sign or parentheses to enter a decrease in profits.) Expected decrease in revenue Expected decrease in total variable costs Expected increase/(decrease) in operating income McCollum V drop Product B because operating income will McCollum (should/ should not) drop product B because income will ( decrease by $40000 / decrease by $5000 / Increase by $40000 / Increase by $5000) 10. If 50% of Product B's fixed costs are avoidable, should McCollum drop Product B? Why or why not? (Use a minus sign or parentheses to enter a decrease in profits.) Expected decrease in revenue Expected decrease in total variable costs Expected decrease in fixed costs Expected decrease in total costs Expected increasel(decrease) in operating income McCollum V drop Product B because operating income will McCollum (should/ should not) drop product B because operating income will (decrease by $17500 / decrease by $5000 / Increase by $17500 / Increase by $5000)

Step by Step Solution

3.50 Rating (150 Votes )

There are 3 Steps involved in it

Answer 9 Exected Decrease In Revenue 75000 Expected ... View full answer

Get step-by-step solutions from verified subject matter experts