Question: Transfer pricing, utilization of capacity. (J. Patell, adapted) The California Instrument Company (CIC) consists of the Semiconductor Division and the Process-Control Division, each of which

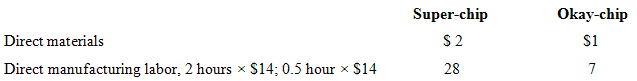

Transfer pricing, utilization of capacity. (J. Patell, adapted) The California Instrument Company (CIC) consists of the Semiconductor Division and the Process-Control Division, each of which operates as an independent profit center. The Semiconductor Division employs craftsmen who produce two different electronic components: the new high-performance Super-chip and an older product called Okay-chip. These two products have the following cost characteristics:

Annual overhead in the Semiconductor Division totals $400,000, all fixed. Due to the high skill level necessary for the craftsmen, the Semiconductor Division’s capacity is set at 50,000 hours per year. One customer orders a maximum of 15,000 Super-chips per year, at a price of $60 per chip. If CIC cannot meet this entire demand, the customer curtails its own production. The rest of the Semiconductor Division’s capacity is devoted to the Okay-chip, for which there is unlimited demand at $12 per chip. The Process-Control Division produces only one product a process-control unit with the following cost structure:

Direct materials (circuit board): $60

Direct manufacturing labor (5 hours × $10): $50

Fixed overhead costs of the Process-Control Division are $80,000 per year. The current market price for the control unit is $132 per unit. A joint research project has just revealed that a single Super-chip could be substituted for the circuit board currently used to make the process-control unit Using Super-chip would require an extra one hour of labor per control unit for a new total of six hours per control unit

1. Calculate the contribution margin per hour of selling Super-chip and Okay-chip. If no transfers of Super-chip are made to the Process-Control Division, how many Super-chips and Okay-chips should the Semiconductor Division sell? Show your computations.

2. The Process-Control Division expects to sell 5,000 process-control units this year. From the viewpoint of California Instruments as a whole, should 5,000 Super-chips be transferred to the Process-Control Division to replace circuit boards? Show your computations.

3. If demand for the process-control unit is certain to be 5,000 units but its price is uncertain, what should the transfer price of Super-chip be to ensure that the division managers’ actions maximize operating income for CIC as a whole? (All other data are unchanged.)

4. If demand for the process-control unit is certain to be 12,000 units, but its price is uncertain, what should the transfer price of Super-chip be to ensure that the division managers’ actions maximize operating income for CIC as a whole? (All other data are unchanged.)

Okay-chip Super-chip $ 2 28 Direct materials $1 Direct manufacturing labor, 2 hours x $14; 0.5 hour x $14

Step by Step Solution

3.49 Rating (185 Votes )

There are 3 Steps involved in it

Transfer pricing utilization of capacity 1 Superchip Okaychip Selling price 60 12 Direct material cost per unit 2 1 Direct manufacturing labor cost per unit 28 7 Contribution margin per unit 30 4 Cont... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

24-B-C-A-M-C-M-I (51).docx

120 KBs Word File