Question: Company D is currently considering financing. If the financing is all equity, the cost of equity is 10%. If a mix of debt and

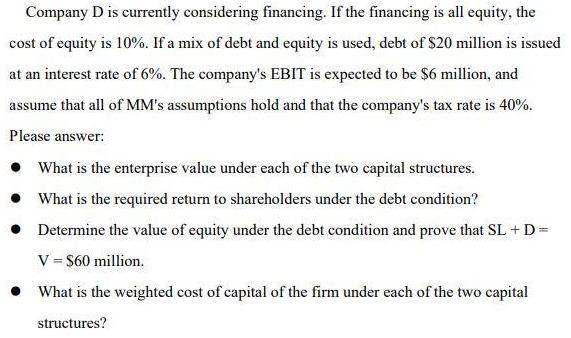

Company D is currently considering financing. If the financing is all equity, the cost of equity is 10%. If a mix of debt and equity is used, debt of $20 million is issued at an interest rate of 6%. The company's EBIT is expected to be $6 million, and assume that all of MM's assumptions hold and that the company's tax rate is 40%. Please answer: What is the enterprise value under each of the two capital structures. What is the required return to shareholders under the debt condition? Determine the value of equity under the debt condition and prove that SL +D= V = $60 million. What is the weighted cost of capital of the firm under each of the two capital structures?

Step by Step Solution

3.42 Rating (171 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts