Question: 0 0 0 0 0 A project is expected to sell one million units initially at a price per unit of $16.50 and a cost

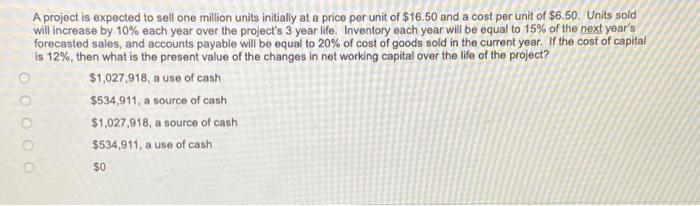

0 0 0 0 0 A project is expected to sell one million units initially at a price per unit of $16.50 and a cost per unit of $6.50. Units sold will increase by 10% each year over the project's 3 year life, Inventory each year will be equal to 15% of the next year's forecasted sales, and accounts payable will be equal to 20% of cost of goods sold in the current year. If the cost of capital is 12%, then what is the present value of the changes in net working capital over the life of the project? $1,027,918, a use of cash $534,911, a source of cash $1,027,918, a source of cash $534,911, a use of cash SO

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts