Question: 0 2 : 3 6 : 2 7 These Remainey 1 3 Mateiple Croice 1 3 points ( Lecture B - Stock Valuation ) Which

::

These Remainey

Mateiple Croice points

Lecture B Stock Valuation

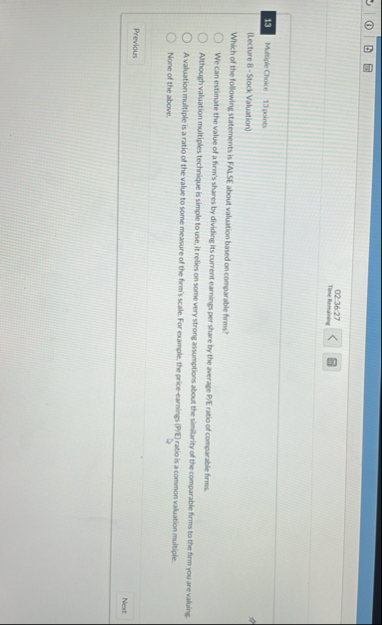

Which of the following statements is FALSE about valuation based on comparable firms?

We can estimate the value of a firm's shares by dividing its current earnings per share by the average P E ratio of comparable firms.

Authough valuation multiples technique is simple to use, it relies on some very strong assumptions about the simalarity of the comparable firms to the firm you are valuing.

A valuation multiple is a ratio of the value to some measure of the firm's scale. For example, the priceearnings PD ratio is a common valuation multiple

None of the above.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock