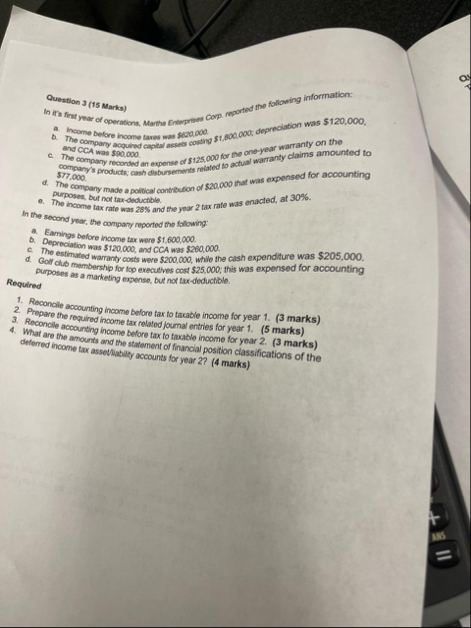

Question: Question 3 ( 1 5 Marks ) corp. reported the following information: a . Income before income laxes was $ 6 2 0 , 0

Question Marks

corp. reported the following information:

a Income before income laxes was $

b The company acquired capital assels conting $; depreciation was $ $ for the oneyear warranty on the

c The company reconded an expense of $ to actual warranty claims amounted to company's products; cash disbursements related to actions $

d The company made a political contribution of $ that was expensed for accounting purposes, but not taxdeductible.

e The income tax rate was and the year tax rate was enacted, at

In the second year, the company reported the following:

a Earnings before income tax were $

b Depreciation was $ and CCA was $

c The estimated warranty costs were $ while the cash expenditure was $

d Golf club membership for lop executhes cost $; this was expensed for accounting purposes as a marketing expense, but not taxdeductible.

Required

Reconolie accounting income before tax to taxable income for year marks

Prepare the required income tax related joumal entries for year marks

Reconcile accounting income before tax to taxable income for year marks

What are the amoun's and the statement of financial position classifications of the deferred income tax asselliability accounts for year marks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock