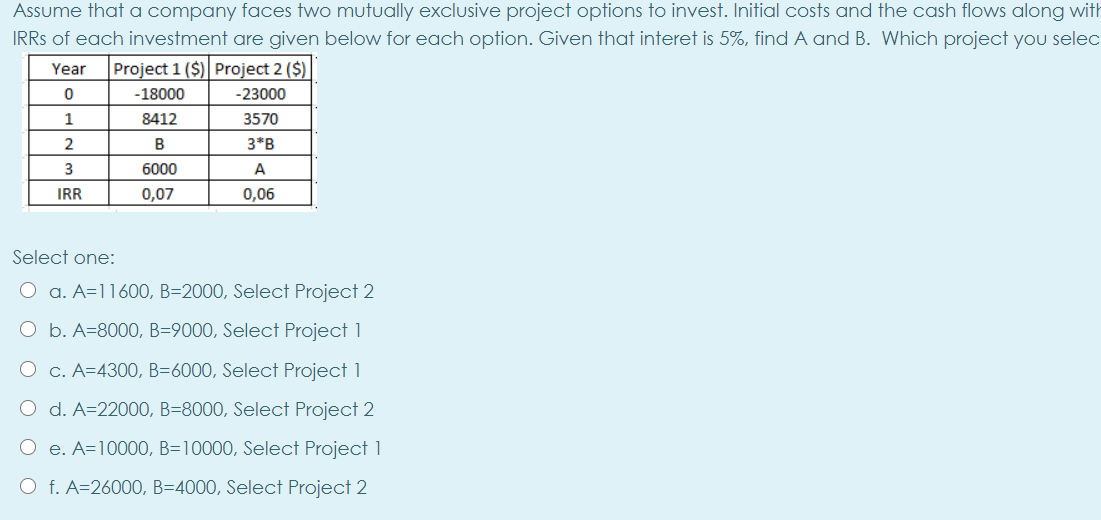

Question: 0 Assume that a company faces two mutually exclusive project options to invest. Initial costs and the cash flows along with IRRs of each investment

0 Assume that a company faces two mutually exclusive project options to invest. Initial costs and the cash flows along with IRRs of each investment are given below for each option. Given that interet is 5%, find A and B. Which project you selec Year Project 1 ($) Project 2 ($) - 18000 -23000 1 8412 3570 2 3 6000 IRR 0,07 0,06 B 3*B Select one: O a. A=11600, B=2000, Select Project 2 O b. A=8000, B=9000, Select Project 1 O c. A=4300, B=6000, Select Project 1 O d. A=22000, B=8000, Select Project 2 O e. A=10000, B=10000, Select Project 1 O f. A=26000, B=4000, Select Project 2

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock