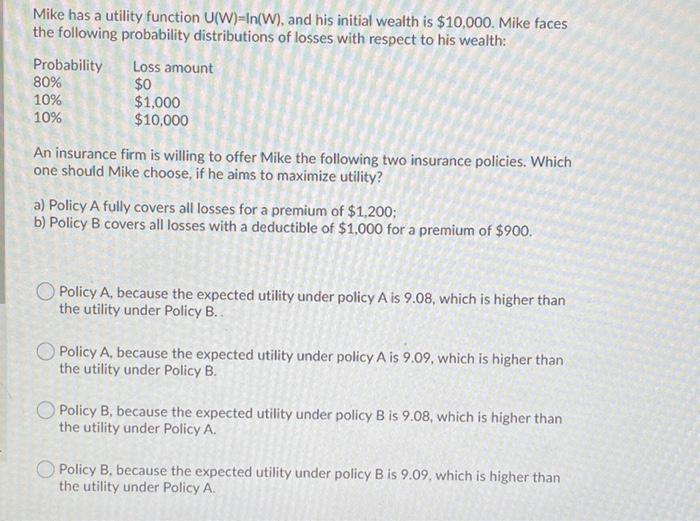

Question: $0 Mike has a utility function U(W)= (W), and his initial wealth is $10,000. Mike faces the following probability distributions of losses with respect to

$0 Mike has a utility function U(W)= (W), and his initial wealth is $10,000. Mike faces the following probability distributions of losses with respect to his wealth: Probability Loss amount 80% 10% $1,000 10% $10,000 An insurance firm is willing to offer Mike the following two insurance policies. Which one should Mike choose, if he aims to maximize utility? a) Policy A fully covers all losses for a premium of $1,200; b) Policy B covers all losses with a deductible of $1,000 for a premium of $900. make choose Policy A, because the expected utility under policy A is 9.08, which is higher than the utility under Policy B. Policy A, because the expected utility under policy Ais 9.09, which is higher than the utility under Policy B. Policy B, because the expected utility under policy B is 9.08, which is higher than the utility under Policy A. Policy B. because the expected utility under policy Bis 9.09, which is higher than the utility under Policy A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts