Question: 0 Reporting Operations in Different Countries Watson Inc., a multinational company, has operating divisions in France, Mexico, and Japan as well as in the United

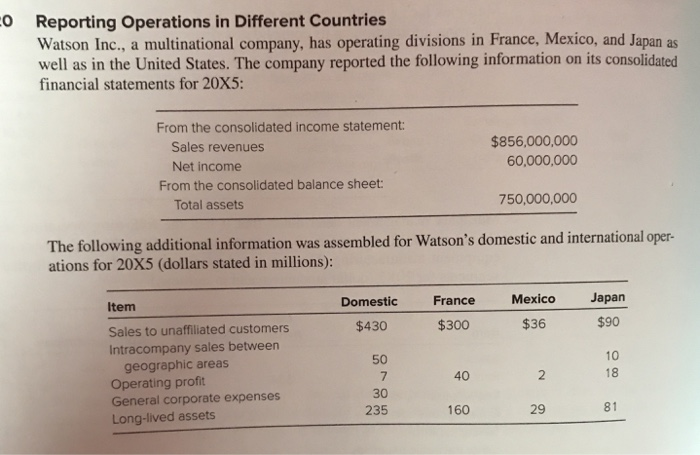

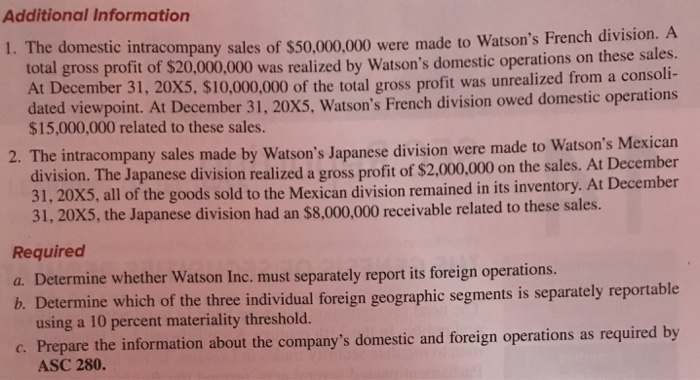

0 Reporting Operations in Different Countries Watson Inc., a multinational company, has operating divisions in France, Mexico, and Japan as well as in the United States. The company reported the following information on its consolidated financial statements for 20X5: From the consolidated income statement: Sales revenues Net income $856,000,000 60,000,000 From the consolidated balance sheet 750,000,000 Total assets The following additional information was assembled for Watson's domestic and international oper- ations for 20X5 (dollars stated in millions): Domestic France Mexico Japan Item Sales to unaffiliated customers Intracompany sales between $430 $300 $36 $90 10 18 geographic areas Operating profit General corporate expenses Long-lived assets 50 7 30 235 40 2 160 29 81 Additional Information 1. The domes tic intracompany sales of $50,000,000 were made to Watson's French division. A gross profit of $20,000,000 was realized by Watson's domestic operations on these sales. At December 31, 20X5, $10,000,000 of the total gross profit was unrealized from a consoli- dated viewpoint. At December 31, 20X5, Watson's French division owed domestic operations $15,000,000 related to these sales. total mpany sales made by Watson's Japanese division were made to Watson's Mexican all of the goods sold to the Mexican division remained in its inventory. At December 2. The intraco division. The Japanese division realized a gross profit of $2.,000,000 on the sales. At December 31, 20X5, profit of $2,000,000 on the sale 5, the Japanese division had an $8,000,000 receivable related to these sales. Required a. Determine whether Watson Inc. must separately report its foreign operations. b. Determine w hich of the three individual foreign geographic segments is separately reportable using a 10 percent materiality threshold. c. Prepare the information about the company's domestic and foreign operations as required by ASC 280

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts