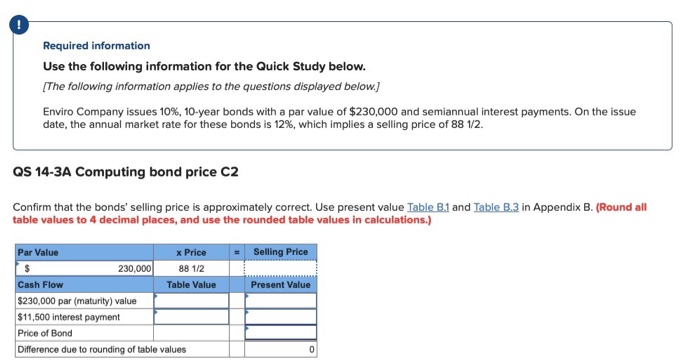

Question: 0 Required information Use the following information for the Quick Study below. The following information applies to the questions displayed below Enviro Company issues 10%,

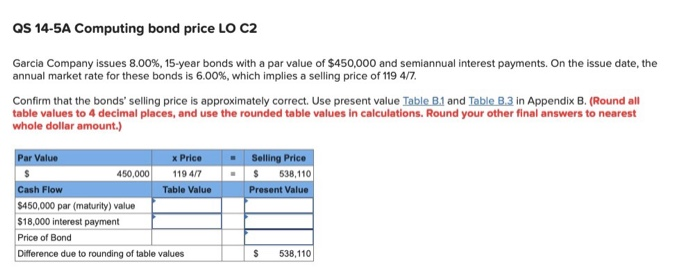

0 Required information Use the following information for the Quick Study below. The following information applies to the questions displayed below Enviro Company issues 10%, 10-year bonds with a par value of $230,000 and semiannual interest payments. On the issue date, the annual market rate for these bonds is 12%, which implies a selling price of 88 12. QS 14-3A Computing bond price C2 Confirm that the bonds' selling price is approximately correct. Use present value Table B.1 and Table B.3 in Appendix B. (Round all table values to 4 decimal places, and use the rounded table values in calculations.) Par Value Selling Price x Price 88 1/2 Table Value 230,000 Cash Flow Present Value $230,000 par (maturity) value 11,500 interest payment Price of Bond Difference due to rounding of table values QS 14-5A Computing bond price LO C2 Garcia Company issues 8.00%, 15-year bonds with a par value of $450,000 and semiannual interest payments. On the issue date, the annual market rate for these bonds is 6.00%, which implies a selling price of 119 47. Confirm that the bonds' selling price is approximately correct. Use present value Table B.1 and Table B.3 in Appendix B. (Round all table values to 4 decimal places, and use the rounded table values in calculations. Round your other final answers to nearest whole dollar amount.) Par Value x PriceSelling Price 50,000 119 4/7 S 538,110 Present Value Table Value Cash Flow $450,000 par (maturity) value $18,000 interest payment Price of Bond Difference due to rounding of table values S 538,110

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts