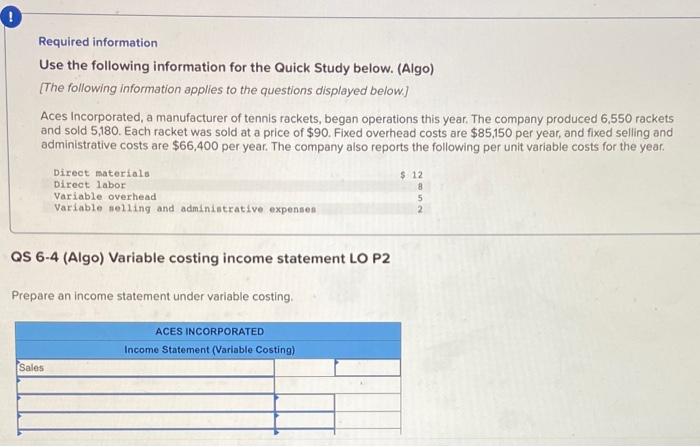

Question: 0 Required information Use the following information for the Quick Study below. (Algo) (The following information applies to the questions displayed below) Aces Incorporated, a

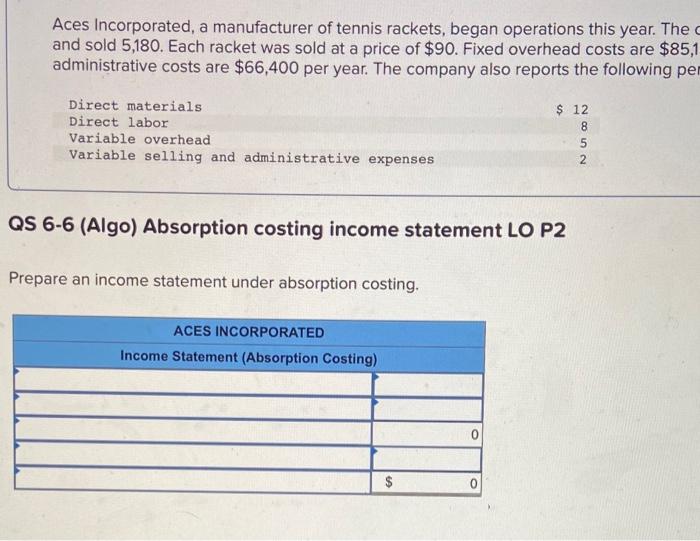

0 Required information Use the following information for the Quick Study below. (Algo) (The following information applies to the questions displayed below) Aces Incorporated, a manufacturer of tennis rackets, began operations this year. The company produced 6,550 rackets and sold 5,180. Each racket was sold at a price of $90. Fixed overhead costs are $85,150 per year , and fixed selling and administrative costs are $66,400 per year. The company also reports the following per unit variable costs for the year. Direct materials $ 12 Direct labor Variable overhead Variable selling and administrative expenses 8 5 2 QS 6-4 (Algo) Variable costing income statement LO P2 Prepare an income statement under variable costing. ACES INCORPORATED Income Statement (Variable Costing) Sales Aces Incorporated, a manufacturer of tennis rackets, began operations this year. The and sold 5,180. Each racket was sold at a price of $90. Fixed overhead costs are $85,1 administrative costs are $66,400 per year. The company also reports the following per Direct materials Direct labor Variable overhead Variable selling and administrative expenses $ 12 8 5 2 NU ON QS 6-6 (Algo) Absorption costing income statement LO P2 Prepare an income statement under absorption costing. ACES INCORPORATED Income Statement (Absorption Costing) $ 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts