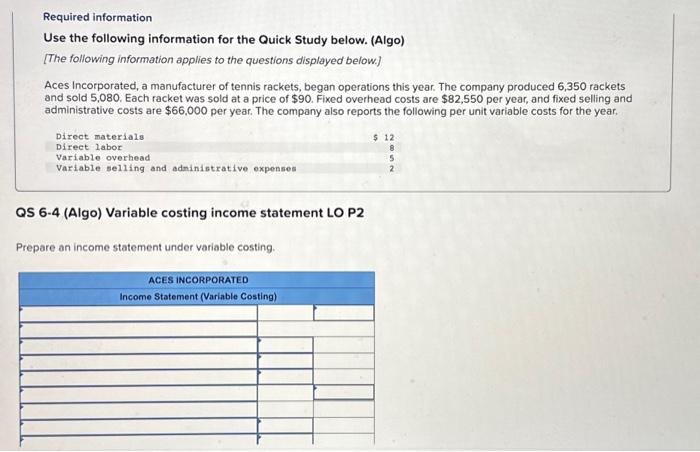

Question: Required information Use the following information for the Quick Study below. (Algo) [The following information applies to the questions displayed below.] Aces Incorporated, a manufacturer

![(Algo) [The following information applies to the questions displayed below.] Aces Incorporated,](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66f1ee67f3601_23966f1ee6796a50.jpg)

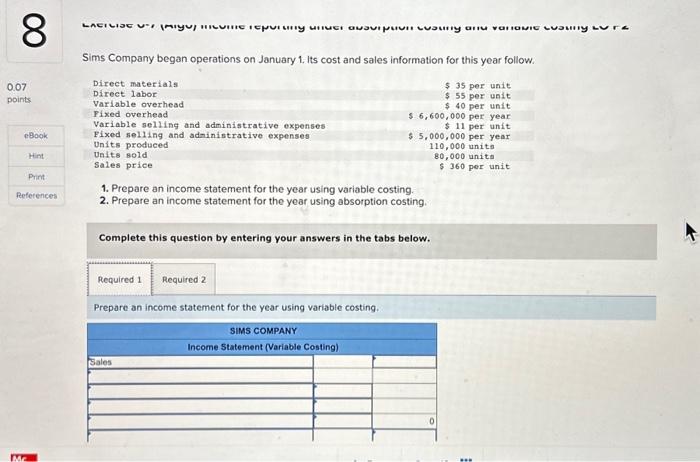

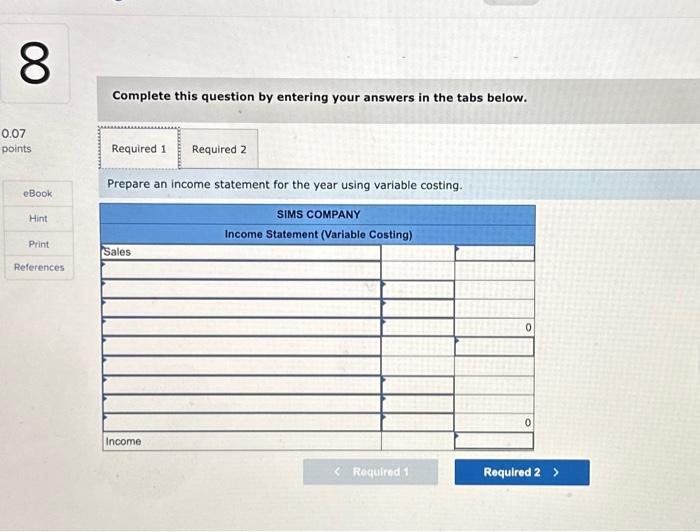

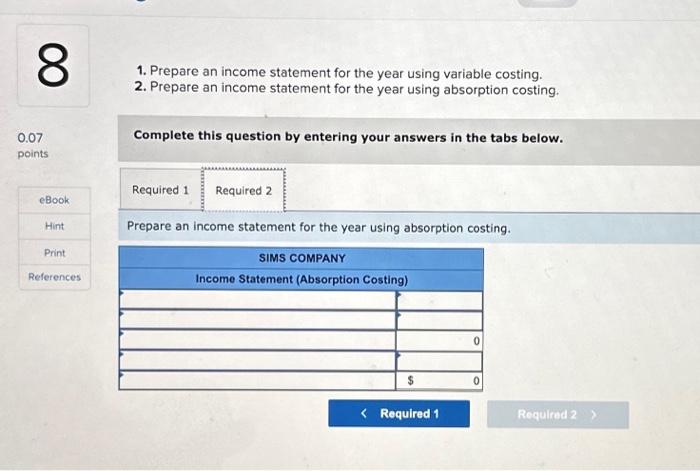

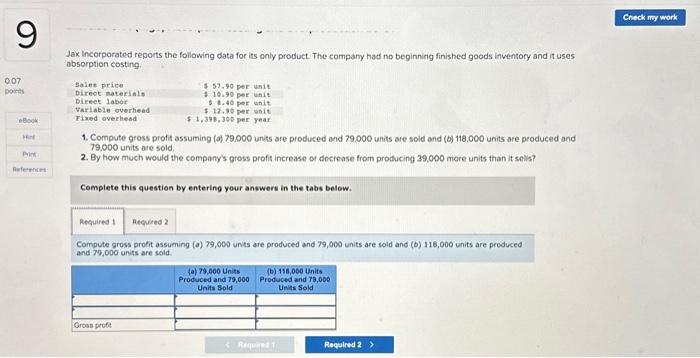

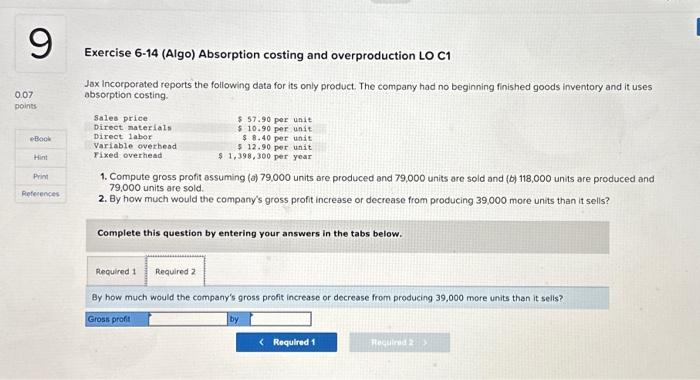

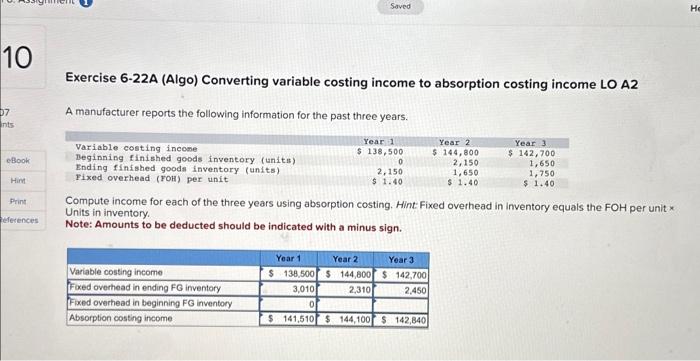

Required information Use the following information for the Quick Study below. (Algo) [The following information applies to the questions displayed below.] Aces Incorporated, a manufacturer of tennis rackets, began operations this year. The company produced 6,350 rackets and sold 5,080 . Each racket was sold at a price of $90. Fixed overhead costs are $82,550 per year, and fixed selling and administrative costs are $66,000 per year. The company also reports the following per unit variable costs for the year. QS 6-4 (Algo) Variable costing income statement LO P2 Prepare an income statement under variable costing. Required information Use the following information for the Quick Study below. (Algo) [The following information applies to the questions displayed below.] Aces Incorporated, a manufacturer of tennis rackets, began operations this year. The company produced 6,350 rackets and sold 5,080 . Each racket was sold at a price of $90. Fixed overhead costs are $82,550 per year, and fixed selling and administrative costs are $66,000 per year. The company also reports the following per unit variable costs for the year. QS 6-7 (Algo) Reporting inventory using absorption costing LO P2 Compute the cost of ending finished goods inventory reported on the balance sheet using absorption costing. Sims Company began operations on January 1 . Its cost and sales information for this year follow. 1. Prepare an income statement for the year using variable costing. 2. Prepare an income statement for the year using absorption costing. Complete this question by entering your answers in the tabs below. Prepare an income statement for the year using variable costing. Complete this question by entering your answers in the tabs below. Prepare an income statement for the year using variable costing. 1. Prepare an income statement for the year using variable costing. 2. Prepare an income statement for the year using absorption costing. Complete this question by entering your answers in the tabs below. Prepare an income statement for the year using absorption costing. lax Incorporated reports the following data for its only product. The company had no beginning finished goods inventory and it uses aborption costing. 1. Compute gross profit assuming (a) 79,000 units are produced and 79,000 units are sold and (b)118,000 units are produced and 79,000 units are sold. 2. By how much would the company's gross profit increase or decrease from producing 39000 more units than it sells? Complete this question by entering your answers in the tabs below. Compute gross profit assuming (a)79,000 units are produced and 79,060 units are sold and (b)116,000 units are peoduced and 79,000 units are sold. Exercise 6-14 (Algo) Absorption costing and overproduction LO C1 Jax incorporated reports the following data for its only product. The company had no beginning finished goods inventory and it uses absorption costing. 1. Compute gross profit assuming (a) 79,000 units are produced and 79,000 units are sold and (b) 118,000 units are produced and 79,000 units are sold. 2. By how much would the company's gross profit increase or decrease from producing 39,000 more units than it sells? Complete this question by entering your answers in the tabs below. By how much would the company's gross profit increase or decrease from producing 39,000 more units than it selis? Exercise 6-22A (Algo) Converting variable costing income to absorption costing income LO A2 A manufacturer reports the following information for the past three years. Compute income for each of the three years using absorption costing. Hint: Fixed overhead in inventory equals the FOH per unit * Units in inventory. Note: Amounts to be deducted should be indicated with a minus sign

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts