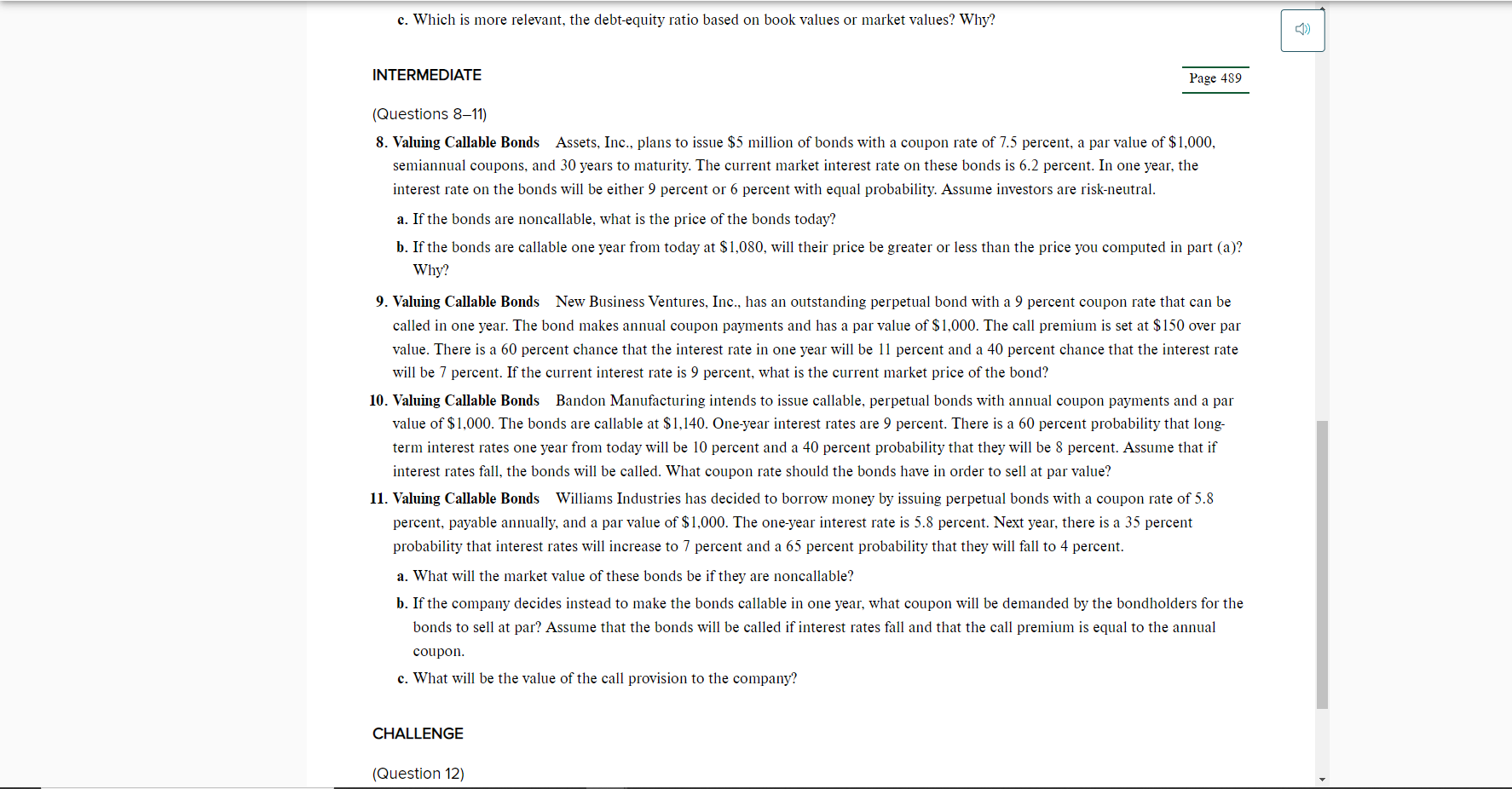

Question: 0. Which is more relevant. the debtequity ratio based on book values or market values? Why? INTERMEDlATE Page 489 (Questions 811) 3. Valuing Callable Bonds

0. Which is more relevant. the debtequity ratio based on book values or market values? Why? INTERMEDlATE Page 489 (Questions 811) 3. Valuing Callable Bonds Assets, Inc.. plans to issue $5 million ofbonds with a coupon rate of 7.5 percent, a par Willie of$1,000. semiannual coupons, and 30 years to maturity. The current market interest rate on these bonds is 6.2 percent. In one year, the interest rate on the bands will be either 9 percent or 6 percent with equal probability. Assume investors are riskrnentral. a. If the bonds are noncallable, what is the price of the bonds today? b. If the bonds are callable one year from today at $1,080, will their price be greater or less than the price you computed in part (a)? Why? 9. Valuing Callable Bonds New Business Ventures. Inc.. has an outstanding perpetual bond with a 9 percent coupon rate that can be called in one year. The bond makes annual coupon payments and has a par value of $1,000. The call premium is set at $150 over par value. There is a 60 percent chance that the interest rate in one year will be ll percent and a 40 percent chance that the interest rate will be 7 percent. If the current interest rate is 9 percent, what is the current market price of the bond? ll]. Valuing Callable Bonds Bandon Manufacturing intends to issue callable, perpetual bonds with annual coupon payments and a par value of $1,000. The bonds are callable at $1,140. Oneryear interest rates are 9 percent. There is a 60 percent probability that long term interest rates one year from today will be 10 percent and a 40 percent probability that they will be 8 percent. Assume that if interest rates fall, the bonds will be called. What coupon rate should the bonds have in order to sell at par value? 11. Valuing Callable Bonds Williams Industries has decided to borrow money by issuing perpetual bonds with a coupon rate of 5.8 percent, payable annually, and a par value 0f$l,000. The oneyear interest rate is 5.8 percent. Next year, there is a 35 percent probability that interest rates Will increase to 7 percent and a 65 percent probabilitythat they will fall to 4 percent. a. What will the market value of these bonds be if they are noncallable'.' I). If the company decides instead to make the bonds callable in one year, What coupon will be demanded in! the bondholders for the bonds to sell at par? Assume that the bonds will be called ifinterest rates fall and that the call premium is equal to the annual Coupon. 0. What will be the value of the call provision to the company? CHALLENGE (Question 12)