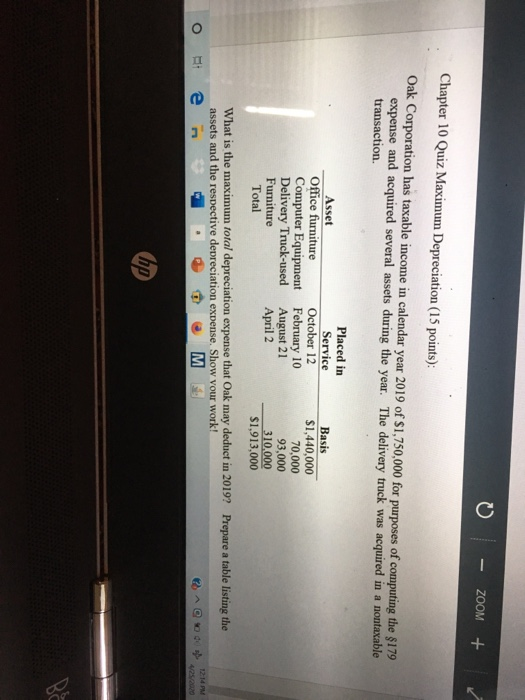

Question: 0 - ZOOM + Chapter 10 Quiz Maximum Depreciation (15 points): Oak Corporation has taxable income in calendar year 2019 of $1,750,000 for purposes of

0 - ZOOM + Chapter 10 Quiz Maximum Depreciation (15 points): Oak Corporation has taxable income in calendar year 2019 of $1,750,000 for purposes of computing the $179 expense and acquired several assets during the year. The delivery truck was acquired in a nontaxable transaction. Placed in Asset Service Basis Office furniture October 12 $1,440,000 Computer Equipment February 10 70,000 Delivery Truck-used August 21 93,000 Furniture April 2 310,000 Total $1,913,000 What is the maximum total depreciation expense that Oak may deduct in 2019? Prepare a table listing the assets and the respective depreciation expense. Show your work! . A 2. 2 .14 PM $1,913,000 What is the maximum total depreciation expense that Oak may deduct in 2019? Prepan assets and the respective depreciation expense. Show your work! 0 - ZOOM + Chapter 10 Quiz Maximum Depreciation (15 points): Oak Corporation has taxable income in calendar year 2019 of $1,750,000 for purposes of computing the $179 expense and acquired several assets during the year. The delivery truck was acquired in a nontaxable transaction. Placed in Asset Service Basis Office furniture October 12 $1,440,000 Computer Equipment February 10 70,000 Delivery Truck-used August 21 93,000 Furniture April 2 310,000 Total $1,913,000 What is the maximum total depreciation expense that Oak may deduct in 2019? Prepare a table listing the assets and the respective depreciation expense. Show your work! . A 2. 2 .14 PM $1,913,000 What is the maximum total depreciation expense that Oak may deduct in 2019? Prepan assets and the respective depreciation expense. Show your work!

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts