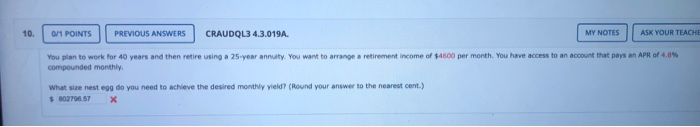

Question: 0/1 POINTS | PREVIOUS ANSWERS CRAUDQL3 4.3.019A. MY NOTES ASK YOUR TEACHE You plan to work for 40 years and then retire using a 25-year

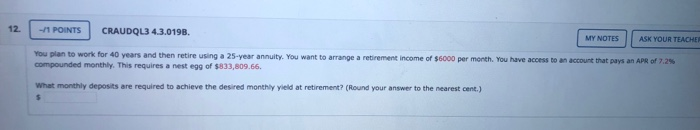

0/1 POINTS | PREVIOUS ANSWERS CRAUDQL3 4.3.019A. MY NOTES ASK YOUR TEACHE You plan to work for 40 years and then retire using a 25-year annuity. You want to arrange a retirement income of $4600 per month. You have access to an account that pays an APR of 4,8% compounded monthly What senesteg do you need to achieve the desired monthly yield? (Round your answer to the nearest cent.) $ 276.57 X 12 -1 POINTS CRAUDQUI 4.3.0198. MY NOTES | ASK YOUR TEACHE You plan to work for 40 years and then retire using a 25-year annuity. You want to arrange a retirement income of $6000 per month. You have access to an account that pays an APR of 7.2% compounded monthly. This requires a nest egg of $833,809.66. What monthly deposits are required to achieve the desired monthly yield at retirement? (Round your answer to the nearest cent.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts