Question: 01. Portfolio Rebalancing Open with Google Docs You have 100 million dollars in your investment account and choose to keep your money allocated in the

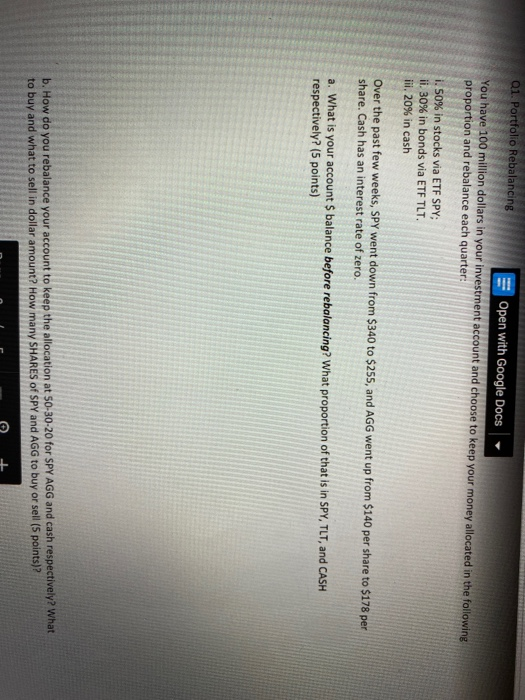

01. Portfolio Rebalancing Open with Google Docs You have 100 million dollars in your investment account and choose to keep your money allocated in the following proportion and rebalance each quarter: i. 50% in stocks via ETF SPY; ii. 30% in bonds via ETF TLT, iii. 20% in cash Over the past few weeks, SPY went down from $340 to $255, and AGG went up from $140 per share to $178 per share. Cash has an interest rate of zero. a. What is your account $ balance before rebalancing? What proportion of that is in SPY, TLT, and CASH respectively? (5 points) b. How do you rebalance your account to keep the allocation at 50-30-20 for SPY AGG and cash respectively? What to buy and what to sell in dollar amount? How many SHARES of SPY and AGG to buy or sell (5 points)? +

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts