Question: 0/1 pts Incorrect Question 2 Consider a binomial tree model in which the length of each time step is 3 months. The annualized volatility of

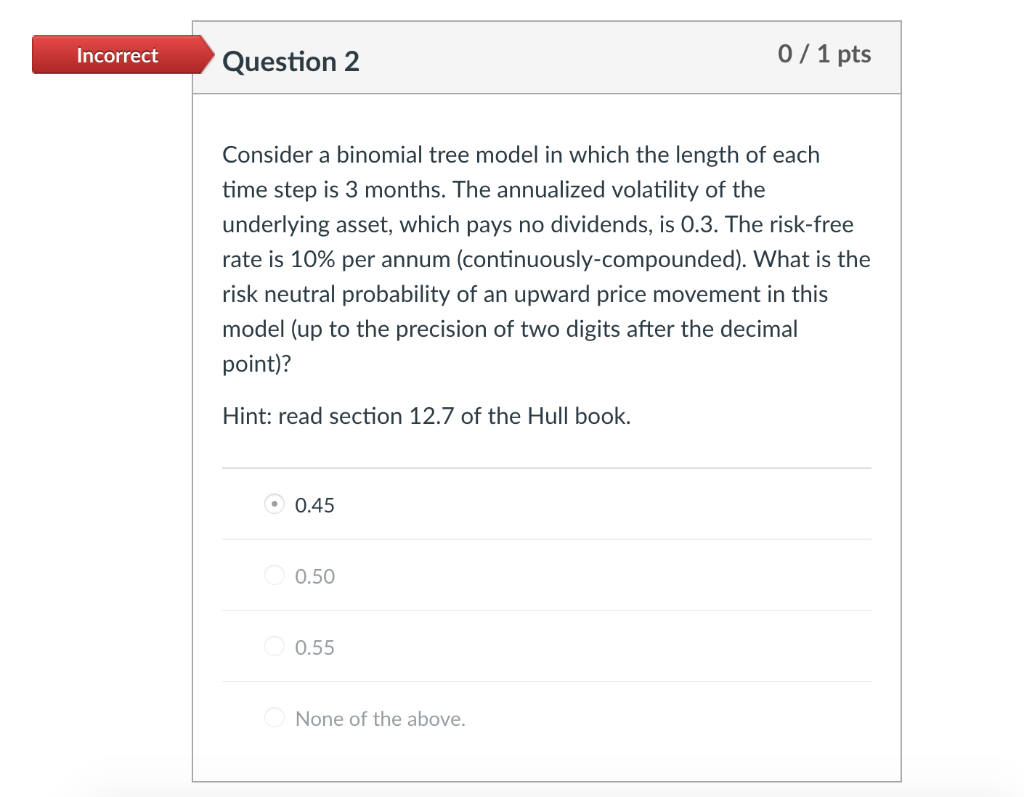

0/1 pts Incorrect Question 2 Consider a binomial tree model in which the length of each time step is 3 months. The annualized volatility of the underlying asset, which pays no dividends, is 0.3. The risk-free rate is 10% per annum (continuously-compounded). what is the risk neutral probability of an upward price movement in this model (up to the precision of two digits after the decimal point)? Hint: read section 12.7 of the Hull book 0.45 0.50 0.55 None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts