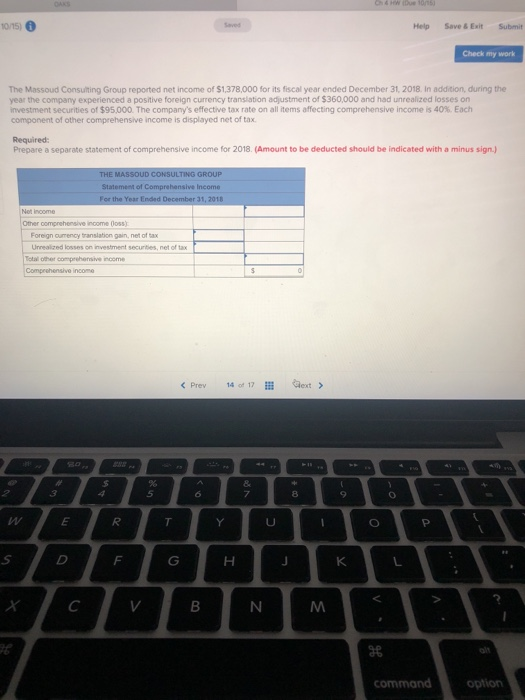

Question: 015) 6 Help Save&Exit Submit Check my work The Massoud Consulting Group reported net income of $1,378,000 for its fiscal year ended December 31, 2018.

015) 6 Help Save&Exit Submit Check my work The Massoud Consulting Group reported net income of $1,378,000 for its fiscal year ended December 31, 2018. In addition, during the year the company experienced a positive foreign currency translation adjustment of $360,000 and had unrealized losses on investment securities of $95,000 The company's effective tax rate on all items affecting comprehensive income is 40% Each component of other comprehensive income is displayed net of tax Required: Prepare a separate statement of comprehensive income for 2018(Amount to be deducted should be indicated with a minus sign Statement of Comprehensive Income Other cor ncome 0loss) Foreign oumency translation gain, net of tax Unreaized losses on investment securities, net of tax Total other CPrev 14 of 1xt > command option

Step by Step Solution

There are 3 Steps involved in it

Statement of Comprehensive Income Preparation Given data Net Income 1378000 Foreign cu... View full answer

Get step-by-step solutions from verified subject matter experts