Question: 0/20 Question 3 Weak-form efficiency, in terms of the Efficient Market Hypothesis of Fama and Samuelson, refers a. The completely random behaviour of asset prices.

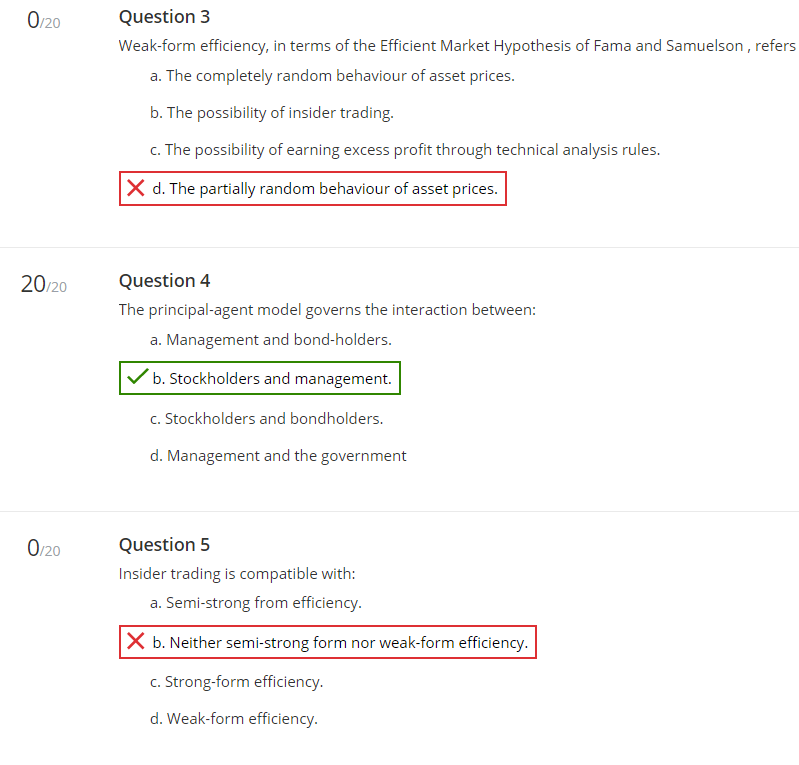

0/20 Question 3 Weak-form efficiency, in terms of the Efficient Market Hypothesis of Fama and Samuelson, refers a. The completely random behaviour of asset prices. b. The possibility of insider trading. C. The possibility of earning excess profit through technical analysis rules. X d. The partially random behaviour of asset prices. 20/20 Question 4 The principal-agent model governs the interaction between: a. Management and bond-holders. b. Stockholders and management. C. Stockholders and bondholders. d. Management and the government 0/20 Question 5 Insider trading is compatible with: a. Semi-strong from efficiency. X b. Neither semi-strong form nor weak-form efficiency. C. Strong-form efficiency. d. Weak-form efficiency

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts