Question: 12:51 Assignment 1 0:20 Question 1 Insider trading is compatible with a. Neither semi-strong form nor weak-form efficiency. b. Weak-form efficiency. X c. Strong-form efficiency.

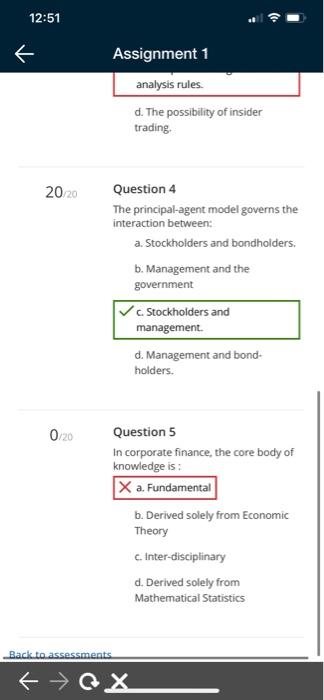

12:51 Assignment 1 0:20 Question 1 Insider trading is compatible with a. Neither semi-strong form nor weak-form efficiency. b. Weak-form efficiency. X c. Strong-form efficiency. d. Semi-strong from efficiency. 020 Question 2 In terms of market efficiency, long-run value maximization for a firm implies: a. A negative NPV. X b. An indeterminate NPV. C. A positive NPV. d. A zero NPV 0/20 Question 3 Weak-form efficiency, in terms of the Efficient Market Hypothesis of Fama and Samuelson, refers to: a. The partially random behaviour of asset prices. b. The completely random behaviour of asset prices X c. The possibility of earning excess profit through-technical KoX 12:51 Assignment 1 d. A zero NPV. 0/20 Question 3 Weak-form efficiency, in terms of the Efficient Market Hypothesis of Fama and Samuelson, refers to a. The partially random behaviour of asset prices b. The completely random behaviour of asset prices. X c. The possibility of earning excess profit through technical analysis rules. d. The possibility of insider trading. 20/20 Question 4 The principal-agent model governs the interaction between a. Stockholders and bondholders. b. Management and the government Stockholders and management d. Management and bond holders. KoX 12:51 R Assignment 1 analysis rules d. The possibility of insider trading, 2020 Question 4 The principal-agent model governs the interaction between: a. Stockholders and bondholders. b. Management and the government V Stockholders and management. d. Management and bond holders. 0/20 Question 5 In corporate finance, the core body of knowledge is : X a. Fundamental b. Derived solely from Economic Theory c. Interdisciplinary d. Derived solely from Mathematical Statistics Back to assessments fX

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts