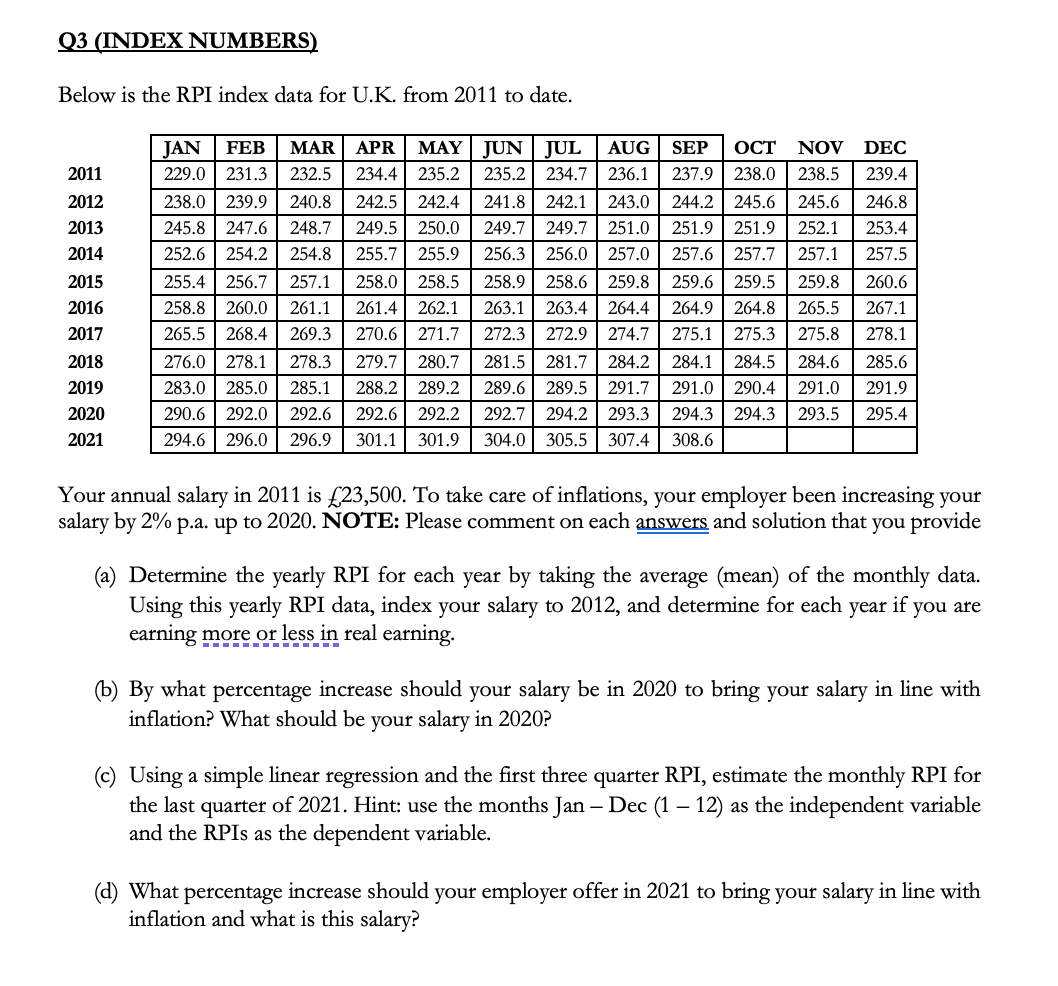

Question: 03 (INDEX NUMBERS) Below is the RPI index data for U.K. from 2011 to date. MAR 232.5 DEC 239.4 2011 2012 2013 2014 246.8 253.4

03 (INDEX NUMBERS) Below is the RPI index data for U.K. from 2011 to date. MAR 232.5 DEC 239.4 2011 2012 2013 2014 246.8 253.4 257.5 JAN FEB 229.0 231.3 238.0 239.9 245.8247.6 252.6 254.2 255.4 | 256.7 258.8 260.0 265.5 268.4 276.0 278.1 283.0 | 285.0 290.6 292.0 294.6 296.0 240.8 248.7 254.8 257.1 261.1 269.3 2015 2016 2017 APR MAY JUN JUL AUG 234.4 235.2 235.2 234.7 | 236.1 242.5 242.4 241.8242.1 243.0 249.5 250.0 249.7 249.7 251.0 255.7 255.9 256.3 256.0 257.0 258.0 258.5 258.9 258.6259.8 261.4 262.1 263.1 263.4 264.4 270.6 | 271.7 272.3 272.9 274.7 279.7 280.7 281.5 281.7 284.2 288.2 289.2 289.5 291.7 292.6 292.2 292.7 294.2 293.3 301.1 301.9 304.0 305.5 | 307.4 SEP OCT NOV 237.9 238.0 238.5 244.2 245.6 245.6 251.9 251.9 252.1 257.6 257.7 257.1 259.6 259.5 259.8 264.9 264.8 265.5 275.1 275.3 275.8 284.1 284.5 284.6 291.0 290.4 291.0 294.3 294.3 293.5 308.6 260.6 267.1 278.1 289.6 2018 2019 2020 2021 278.3 285.1 292.6 296.9 285.6 291.9 295.4 Your annual salary in 2011 is 23,500. To take care of inflations, your employer been increasing your salary by 2% p.a. up to 2020. NOTE: Please comment on each answers and solution that you provide (a) Determine the yearly RPI for each year by taking the average (mean) of the monthly data. Using this yearly RPI data, index your salary to 2012, and determine for each year if you are earning more or less in real earning. (b) By what percentage increase should your salary be in 2020 to bring your salary in line with inflation? What should be your salary in 2020? (c) Using a simple linear regression and the first three quarter RPI, estimate the monthly RPI for the last quarter of 2021. Hint: use the months Jan - Dec (1 12) as the independent variable and the RPIs as the dependent variable. (d) What percentage increase should your employer offer in 2021 to bring your salary in line with inflation and what is this salary? 03 (INDEX NUMBERS) Below is the RPI index data for U.K. from 2011 to date. MAR 232.5 DEC 239.4 2011 2012 2013 2014 246.8 253.4 257.5 JAN FEB 229.0 231.3 238.0 239.9 245.8247.6 252.6 254.2 255.4 | 256.7 258.8 260.0 265.5 268.4 276.0 278.1 283.0 | 285.0 290.6 292.0 294.6 296.0 240.8 248.7 254.8 257.1 261.1 269.3 2015 2016 2017 APR MAY JUN JUL AUG 234.4 235.2 235.2 234.7 | 236.1 242.5 242.4 241.8242.1 243.0 249.5 250.0 249.7 249.7 251.0 255.7 255.9 256.3 256.0 257.0 258.0 258.5 258.9 258.6259.8 261.4 262.1 263.1 263.4 264.4 270.6 | 271.7 272.3 272.9 274.7 279.7 280.7 281.5 281.7 284.2 288.2 289.2 289.5 291.7 292.6 292.2 292.7 294.2 293.3 301.1 301.9 304.0 305.5 | 307.4 SEP OCT NOV 237.9 238.0 238.5 244.2 245.6 245.6 251.9 251.9 252.1 257.6 257.7 257.1 259.6 259.5 259.8 264.9 264.8 265.5 275.1 275.3 275.8 284.1 284.5 284.6 291.0 290.4 291.0 294.3 294.3 293.5 308.6 260.6 267.1 278.1 289.6 2018 2019 2020 2021 278.3 285.1 292.6 296.9 285.6 291.9 295.4 Your annual salary in 2011 is 23,500. To take care of inflations, your employer been increasing your salary by 2% p.a. up to 2020. NOTE: Please comment on each answers and solution that you provide (a) Determine the yearly RPI for each year by taking the average (mean) of the monthly data. Using this yearly RPI data, index your salary to 2012, and determine for each year if you are earning more or less in real earning. (b) By what percentage increase should your salary be in 2020 to bring your salary in line with inflation? What should be your salary in 2020? (c) Using a simple linear regression and the first three quarter RPI, estimate the monthly RPI for the last quarter of 2021. Hint: use the months Jan - Dec (1 12) as the independent variable and the RPIs as the dependent variable. (d) What percentage increase should your employer offer in 2021 to bring your salary in line with inflation and what is this salary

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts