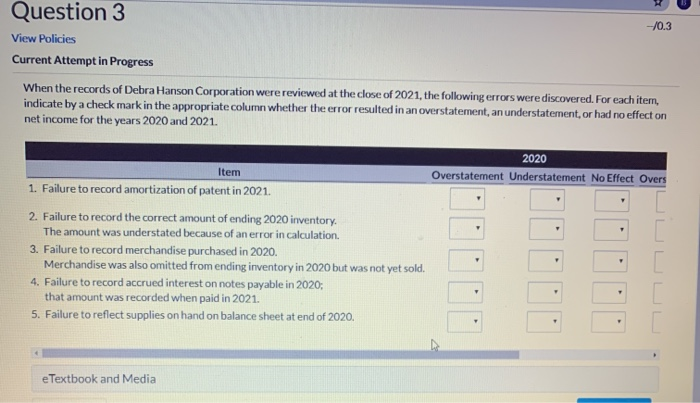

Question: --/0.3 Question 3 View Policies Current Attempt in Progress When the records of Debra Hanson Corporation were reviewed at the close of 2021, the following

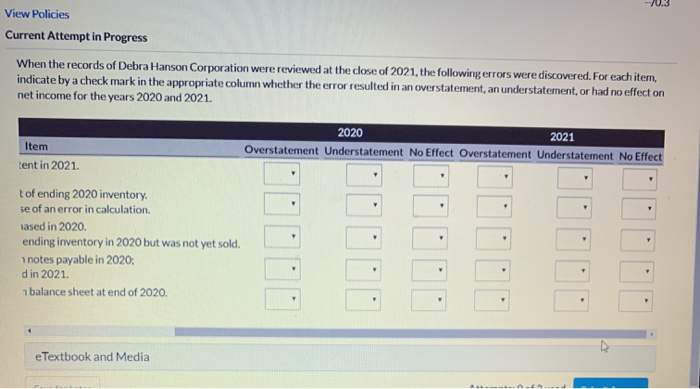

--/0.3 Question 3 View Policies Current Attempt in Progress When the records of Debra Hanson Corporation were reviewed at the close of 2021, the following errors were discovered. For each item, indicate by a check mark in the appropriate column whether the error resulted in an overstatement, an understatement, or had no effect on net income for the years 2020 and 2021. 2020 Overstatement Understatement No Effect Overs Item 1. Failure to record amortization of patent in 2021. 2. Failure to record the correct amount of ending 2020 inventory. The amount was understated because of an error in calculation 3. Failure to record merchandise purchased in 2020. Merchandise was also omitted from ending inventory in 2020 but was not yet sold. 4. Failure to record accrued interest on notes payable in 2020, that amount was recorded when paid in 2021. 5. Failure to reflect supplies on hand on balance sheet at end of 2020. e Textbook and Media View Policies Current Attempt in Progress When the records of Debra Hanson Corporation were reviewed at the close of 2021, the following errors were discovered. For each item. indicate by a check mark in the appropriate column whether the error resulted in an overstatement, an understatement, or had no effect on net income for the years 2020 and 2021. 2021 2020 Overstatement Understatement No Effect Overstatement Understatement No Effect Item tent in 2021. tof ending 2020 inventory. se of an error in calculation lased in 2020 ending inventory in 2020 but was not yet sold. 1 notes payable in 2020, d in 2021 balance sheet at end of 2020. eTextbook and Media

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts