Question: 0.4 Question 2 Camdi plc is a large UK based company that manufactures construction equipment. The company has just arranged to supply a French customer

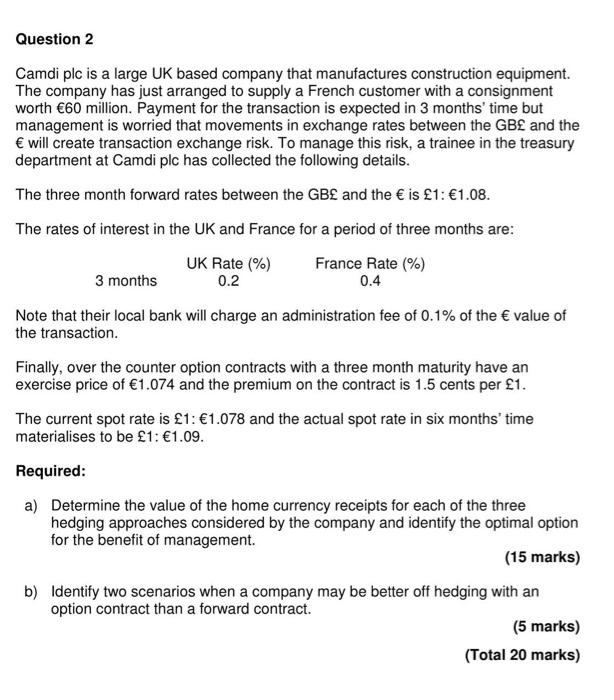

0.4 Question 2 Camdi plc is a large UK based company that manufactures construction equipment. The company has just arranged to supply a French customer with a consignment worth 60 million. Payment for the transaction is expected in 3 months' time but management is worried that movements in exchange rates between the GB and the will create transaction exchange risk. To manage this risk, a trainee in the treasury department at Camdi plc has collected the following details. The three month forward rates between the GB and the is 1: 1.08. The rates of interest in the UK and France for a period of three months are: UK Rate (%) France Rate (%) 3 months 0.2 Note that their local bank will charge an administration fee of 0.1% of the value of the transaction. Finally, over the counter option contracts with a three month maturity have an exercise price of 1.074 and the premium on the contract is 1.5 cents per 1. The current spot rate is 1: 1.078 and the actual spot rate in six months' time materialises to be 1: 1.09. Required: a) Determine the value of the home currency receipts for each of the three hedging approaches considered by the company and identify the optimal option for the benefit of management. (15 marks) b) Identify two scenarios when a company may be better off hedging with an option contract than a forward contract. (5 marks) (Total 20 marks) Question 7 Corporate valuation techniques are similar whether used by investment bankers in the context of mergers and acquisitions or by private investors. Discuss. (Total 20 marks) Question 8 Describe the different forms of market efficiency and discuss the extent to which you believe developed markets such as the London Stock Exchange and the New York Stock Exchange are completely semi-strong efficient. (Total 20 marks) 0.4 Question 2 Camdi plc is a large UK based company that manufactures construction equipment. The company has just arranged to supply a French customer with a consignment worth 60 million. Payment for the transaction is expected in 3 months' time but management is worried that movements in exchange rates between the GB and the will create transaction exchange risk. To manage this risk, a trainee in the treasury department at Camdi plc has collected the following details. The three month forward rates between the GB and the is 1: 1.08. The rates of interest in the UK and France for a period of three months are: UK Rate (%) France Rate (%) 3 months 0.2 Note that their local bank will charge an administration fee of 0.1% of the value of the transaction. Finally, over the counter option contracts with a three month maturity have an exercise price of 1.074 and the premium on the contract is 1.5 cents per 1. The current spot rate is 1: 1.078 and the actual spot rate in six months' time materialises to be 1: 1.09. Required: a) Determine the value of the home currency receipts for each of the three hedging approaches considered by the company and identify the optimal option for the benefit of management. (15 marks) b) Identify two scenarios when a company may be better off hedging with an option contract than a forward contract. (5 marks) (Total 20 marks) Question 7 Corporate valuation techniques are similar whether used by investment bankers in the context of mergers and acquisitions or by private investors. Discuss. (Total 20 marks) Question 8 Describe the different forms of market efficiency and discuss the extent to which you believe developed markets such as the London Stock Exchange and the New York Stock Exchange are completely semi-strong efficient. (Total 20 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts