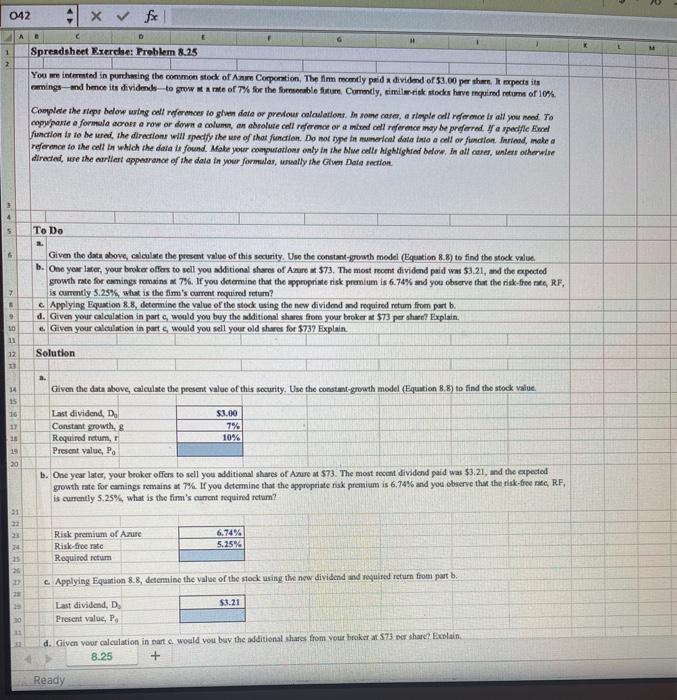

Question: 042 A 1 2 Spreadsheet Exercise: Problem 8.25 You are interested in purchasing the common stock of Azure Corporation, The flm momtly paid divided of

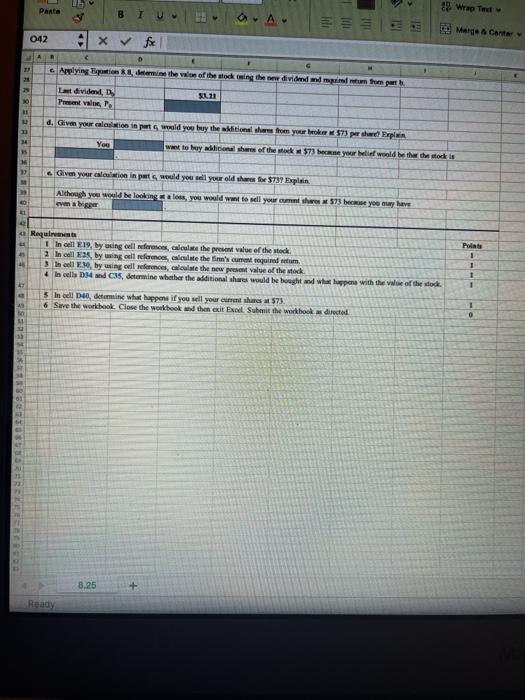

042 A 1 2 Spreadsheet Exercise: Problem 8.25 You are interested in purchasing the common stock of Azure Corporation, The flm momtly paid divided of 53.00 per than expects its comings-und hmoe its dividends-to grow Art of 7% for the foresemble future Currmdly, similar stocks have required retums of 10% Complete the repr below wring all references to give data or predow oslavlation. In some camera simple cell reference r all you need to copy paste a formula acron a row or down a column, an absolute cell refermor or a miedoll reference may be preferred. We speciflc Eco function is to be ure, the direction will pactly there of that function. Do mot type in mineral data into a call or function. Innan make a reference to the cell in which the data is found. Make your computation only in the blue celles Mighlighted blow. In all otres, unless otherwise directa re the earliest appearance of the data in your formular, wually the Glen Data rection 5 To Do 1. 7 Given the data above, alte the present value of this security. Use the constant-growth model (Equation 8. 8) to find the stock value b. One year later, your broker offers to sell you additional shares of Anure 373. The most recent dividend paid was $3.21, and the expected growth rate for comings remains 7%. If you determine that the appropriate risk premium is 6.74% and you observe that the risk-fronte, RF, is currently 5.25%, what is the fim's current required retur? Applying Equation 8.8, determine the value of the stock using the new dividend and required retum from part b. d. Given your calculation in parte, would you buy the additional shares from your broker ut $73 per she? Explain. Given your calculation in part would you sell your old shares for $73? Explain 9 10 11 12 Solution Given the data above, calculate the present value of this security. Use the constant-growth model (Equation 8.8) to find the stock value 34 15 16 Last dividend, De Constant growth Required retum, Present value, Po $3.00 7% 10% 19 20 b. One year later, your broker offers to sell you additional shares of Anure at $73. The most recent dividend paid was $3.21, and the expected growth rate for earnings remains at 7%. If you determine that the appropriate risk premium is 6.74% and you observe that the risk-free, RF, is currently 5.25%, what is the firm's current required return Risk premium of Azure Risk-free rate Required return 5.25% BAHAR . Applying Equation 8.8, determine the value of the stock using the new dividend and required return from part b. 53.21 Last dividend, D Present value, Po 30 d. Given your calculation in part would you buy the additional shares from your broker $73. or share! Explain 8.25 + Ready

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts