Question: 1 0 . 1 : Case Assignment ( 6 0 marks total ) Choose two companies in the same industry in Canada. Read the instructions

: Case Assignment marks total

Choose two companies in the same industry in Canada. Read the instructions for question before making your choices as you will use the same firms for questions and

In one paragraph, describe your choice of firms and industry, noting in particular what you hope to learn from your financial statement analysis. Provide URLs to the financial statements on the firms website.

Marks will be awarded choosing less common firmsindustry Common and frequently chosen firms and industries will receive fewer marks in this regard.

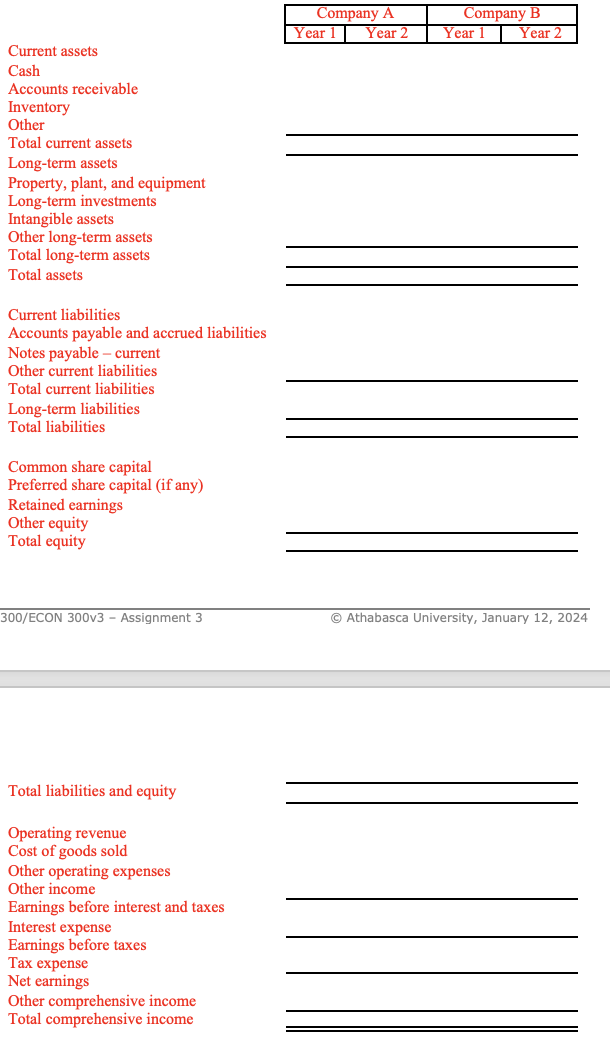

Summarize each firms income statement and balance sheet for the last two fiscal years into the categories below. Complete the attached tables an Excel template is available in the Assignment dropbox area of the course website with this information. You may cut and paste into and from Microsoft Excel for this assignment.

Company A Company B

Year Year Year Year

Current assets

Cash

Accounts receivable

Inventory

Other

Total current assets

Longterm assets

Property, plant, and equipment

Longterm investments

Intangible assets

Other longterm assets

Total longterm assets

Total assets

Current liabilities

Accounts payable and accrued liabilities

Notes payable current

Other current liabilities

Total current liabilities

Longterm liabilities

Total liabilities

Common share capital

Preferred share capital if any

Retained earnings

Other equity

Total equity

Total liabilities and equity

Operating revenue Current assets

Cash

Accounts receivable

Inventory

Other

Total current assets

Longterm assets

Property, plant, and equipment

Longterm investments

Intangible assets

Other longterm assets

Total longterm assets

Total assets

Current liabilities

Accounts payable and accrued liabilities

Notes payable current

Other current liabilities

Total current liabilities

Longterm liabilities

Total liabilities

Common share capital

Preferred share capital if any

Retained earnings

Other equity

Total equity

ECON v Assignment

c Athabasca University, January

Total liabilities and equity

Operating revenue

Cost of goods sold

Other operating expenses

Other income

Earnings before interest and taxes

Interest expense

Earnings before taxes

Tax expense

Net earnings

Other comprehensive income

Total comprehensive income

Cost of goods sold

Other operating expenses

Other income

Earnings before interest and taxes

Interest expense

Earnings before taxes

Tax expense

Net earnings

Other comprehensive income

Total comprehensive income

Required:

a Choose two firms from a single industry, and outline why you selected these firms eg uniqueness, interest, other marks

b Describe the firms performance relative to each other using only the financial information shown on the face of the financial statements, in particular the income statement and balance sheet. marks

c Review the cash flow statements for the two firms and comment on the firms performance relative to each other. marks

d Calculate the ratios given in the textbook. Note any that you were unable to calculate due to a lack of information in the firms financial statements. marks

e Describe the firms performance relative to each other using the ratios you calculated. Address all the five types of ratios and the DuPont analysis in your discussion of performance. marks

f Compute and consider the firms degree of operating leverage in both years and draw conclusions regarding which firm has a riskier or more conservative cost structure. marks

g Summarize your results and discuss which firm you think is the better investment choice and why. marks

h Identify and discuss what you think are the key critical factors for success in the industrybusiness in which the firms are operating. marks

i Note how well each firm is addressing the critical success factors and compare the firms, using your preceding analysis to support your conclusion. marks

If you use Excel for the calculations in this assignment, you must cut and paste the results into your Word document for submission. You may include your Excel worksheet file when you upload your work for grading, but what is included in the Word document will be used to award grades.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock