Question: 1 0 : 5 3 LTE , Bae ; 0 : 2 6 - 0 : 2 6 BS 3 5 0 - BF 3

:

LTE

Bae ; ::

BS BF BSP Assi...

Done

Question

Portfolio management is concerned with making decisions about investment mix and policy, matching investments to objectives, asset allocation for individuals and institutions, and balancing risk against performance.

i Explain the difference between Active and Passive portfolio management.

ii Explain the two main strategies in passive portfolio management and comment on the effectiveness of the strategies in achieving the desired outcome.

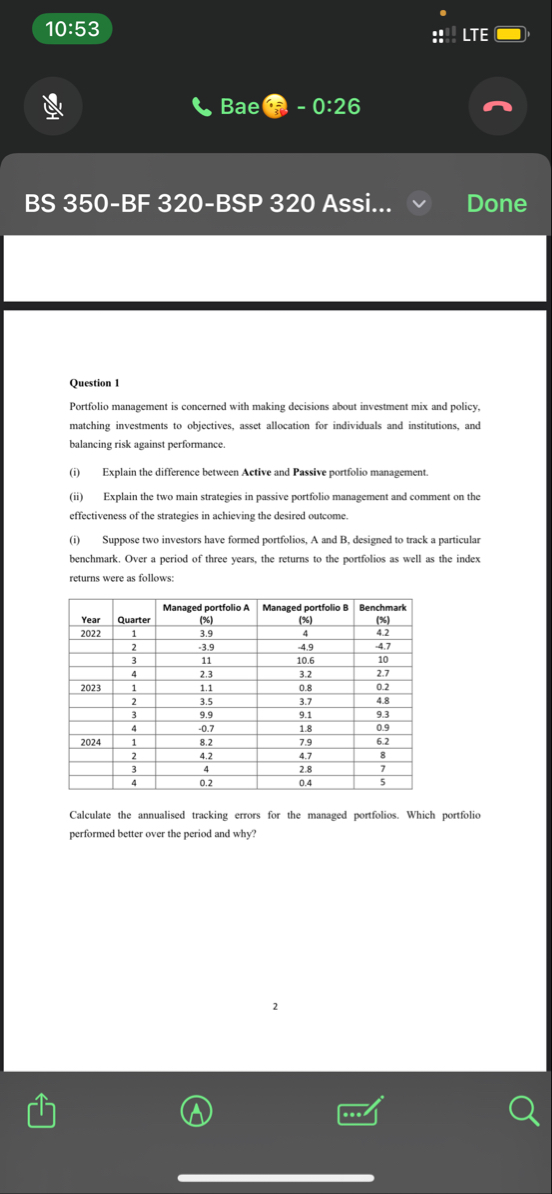

i Suppose two investors have formed portfolios, A and B designed to track a particular benchmark. Over a period of three years, the returns to the portfolios as well as the index returns were as follows:

tableYearQuarter,Managed portfolio A Managed portfolio B Benchmark

Calculate the annualised tracking errors for the managed portfolios. Which portfolio performed better over the period and why?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock