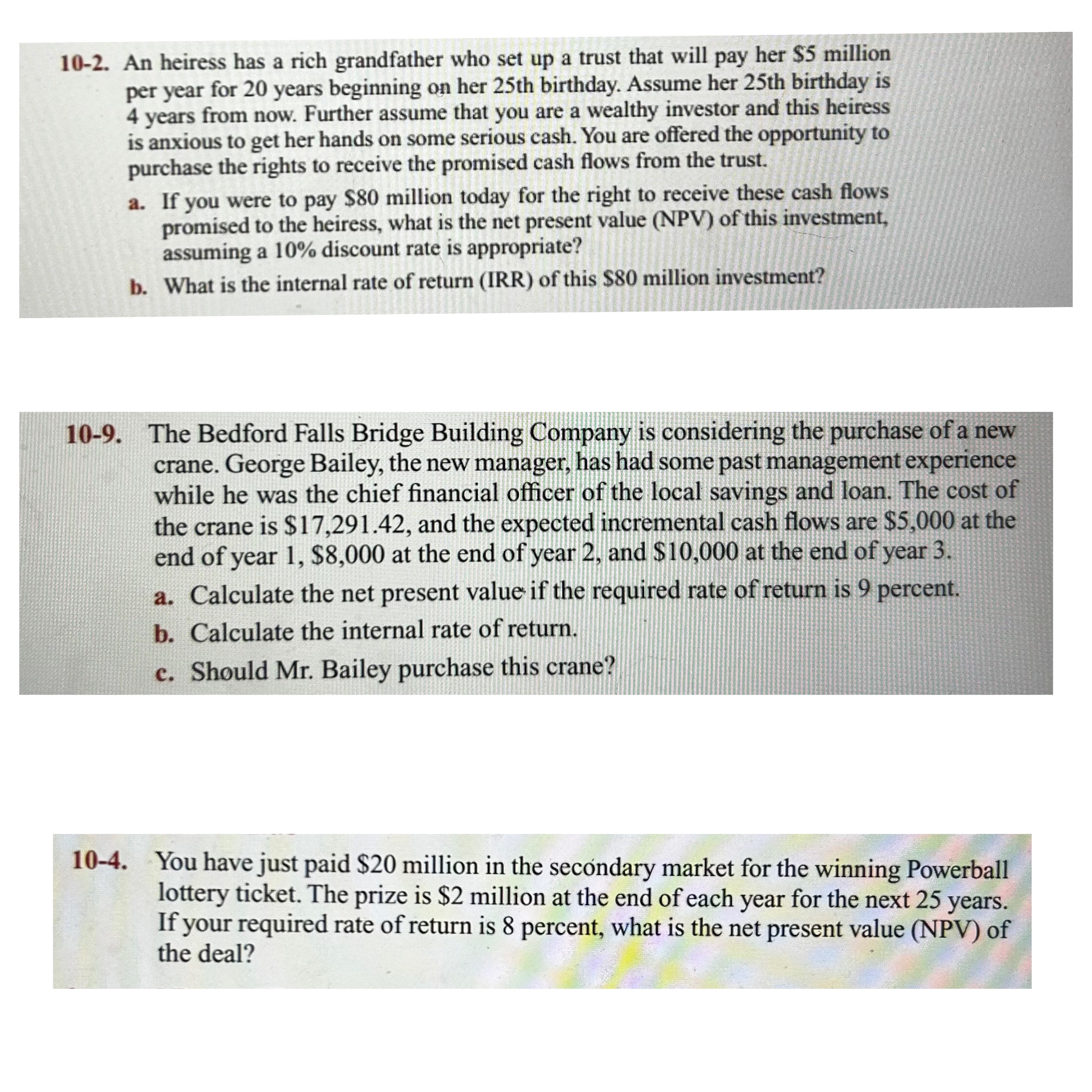

Question: 1 0 - 9 . The Bedford Falls Bridge Building Company is considering the purchase of a new crane. George Bailey, the new manager, has

The Bedford Falls Bridge Building Company is considering the purchase of a new

crane. George Bailey, the new manager, has had some past management experience

while he was the chief financial officer of the local savings and loan. The cost of

the crane is $ and the expected incremental cash flows are $ at the

end of year $ at the end of year and $ at the end of year

a Calculate the net present value if the required rate of return is percent.

b Calculate the internal rate of return.

c Should Mr Bailey purchase this crane?

You have just paid $ million in the secondary market for the winning Powerball

lottery ticket. The prize is $ million at the end of each year for the next years.

If your required rate of return is percent, what is the net present value NPV of

the deal?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock