Question: ( 1 0 ) Q . No 3 : On December 3 1 , 2 0 0 0 Kay architectural services purchased equipment at a

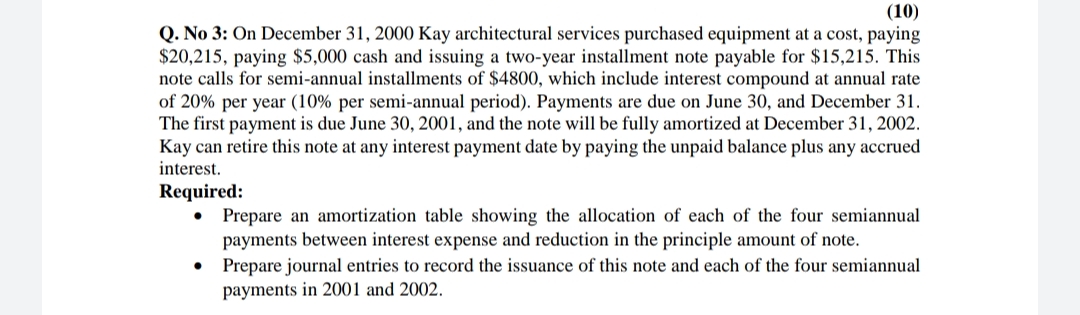

Q No : On December Kay architectural services purchased equipment at a cost, paying $ paying $ cash and issuing a twoyear installment note payable for $ This note calls for semiannual installments of $ which include interest compound at annual rate of per year per semiannual period Payments are due on June and December The first payment is due June and the note will be fully amortized at December Kay can retire this note at any interest payment date by paying the unpaid balance plus any accrued interest.

Required:

Prepare an amortization table showing the allocation of each of the four semiannual payments between interest expense and reduction in the principle amount of note.

Prepare journal entries to record the issuance of this note and each of the four semiannual payments in and

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock