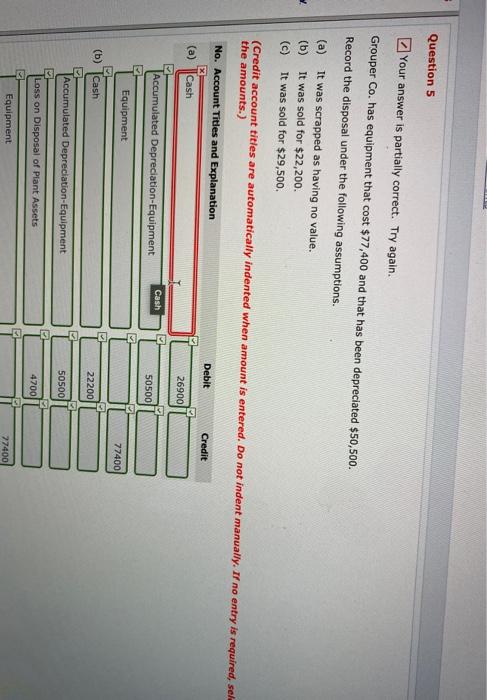

Question: Question 5 Your answer is partially correct. Try again. Grouper Co. has equipment that cost $77,400 and that has been depreciated $50,500. Record the disposal

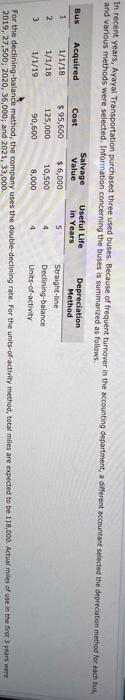

Question 5 Your answer is partially correct. Try again. Grouper Co. has equipment that cost $77,400 and that has been depreciated $50,500. Record the disposal under the following assumptions. (a) It was scrapped as having no value. (b) It was sold for $22,200. It was sold for $29,500. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, sel the amounts.) No. Account Titles and Explanation X (a) Cash Debit Credit 26900 Accumulated Depreciation Equipment Cash 50500 Equipment 77400 (b) Cash 22200 Accumulated Depreciation-Equipment 50500 E2 Loss on Disposal of Plant Assets 4700 Equipment 27400 In recent years, Ayayal Transportation purchased three used buses. Because of frequent turnover in the accounting department, a different accountant selected the depreciation method for each bus, and various methods were selected. Information concerning the buses is summarized as follows: Salvage Useful Life Depreciation Bus Acquired Cost Value in Years Method 1 1/1/18 $ 95,600 $ 6,000 5 Straight-line 2 1/1/18 125,000 10,500 Dedining-balance 3 1/1/19 90,600 8,000 Units-of-activity For the declining-balance method, the company uses the double-declining rate. For the units-of-activity method, total miles are expected to be 118,000. Actual miles of use the first were 2019, 27,500; 2020, 36,000; and 2021, 33,000 Compute the amount of accumulated depreciation on each bus at December 31, 2020. (Round answers to o de Accumulated depreciation X BUS 1 BUS 2 DOO BUS 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts