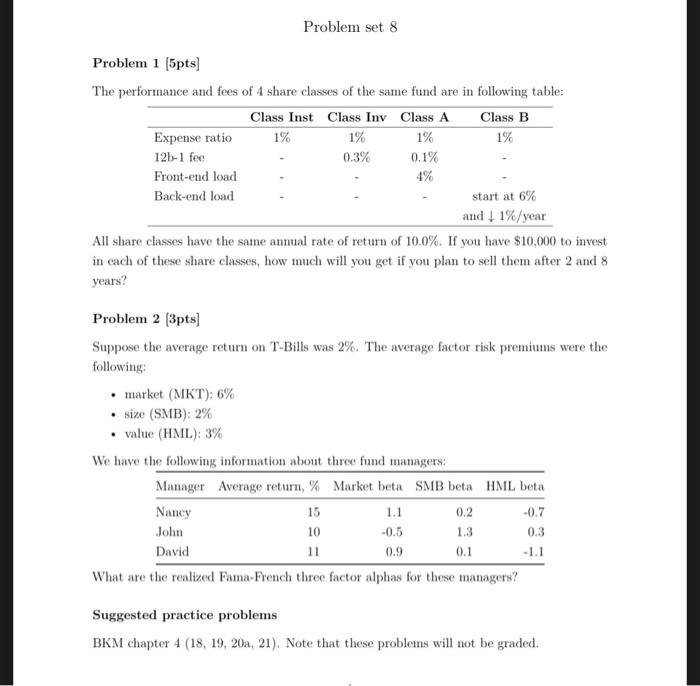

Question: 1% 1% 1% Problem set 8 Problem 1 [5pts) The performance and fees of 4 share classes of the same fund are in following table:

1% 1% 1% Problem set 8 Problem 1 [5pts) The performance and fees of 4 share classes of the same fund are in following table: Class Inst Class InvClass A Class B Expense ratio 1% 125-1 fee 0.3% 0.1% Front-end load 4% Back-end load start at 6% and | 1%/year All share classes have the same annual rate of return of 10.0%. If you have $10,000 to invest in each of these share classes, how much will you get if you plan to sell them after 2 and 8 years? Problem 2 3pts) Suppose the average return on T-Bills was 2%. The average factor risk premiums were the following: market (MKT): 6% size (SMB): 2% value (HML): 3% We have the following information about three fund managers: Manager Average return, % Market beta SMB beta HML beta Nancy 15 1.1 0.2 -0.7 John 10 1.3 0.3 David 11 0.1 -1.1 What are the realized Fama-French three factor alphas for these managers? 0.9 Suggested practice problems BKM chapter 4 (18, 19, 20, 21). Note that these problems will not be graded

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts