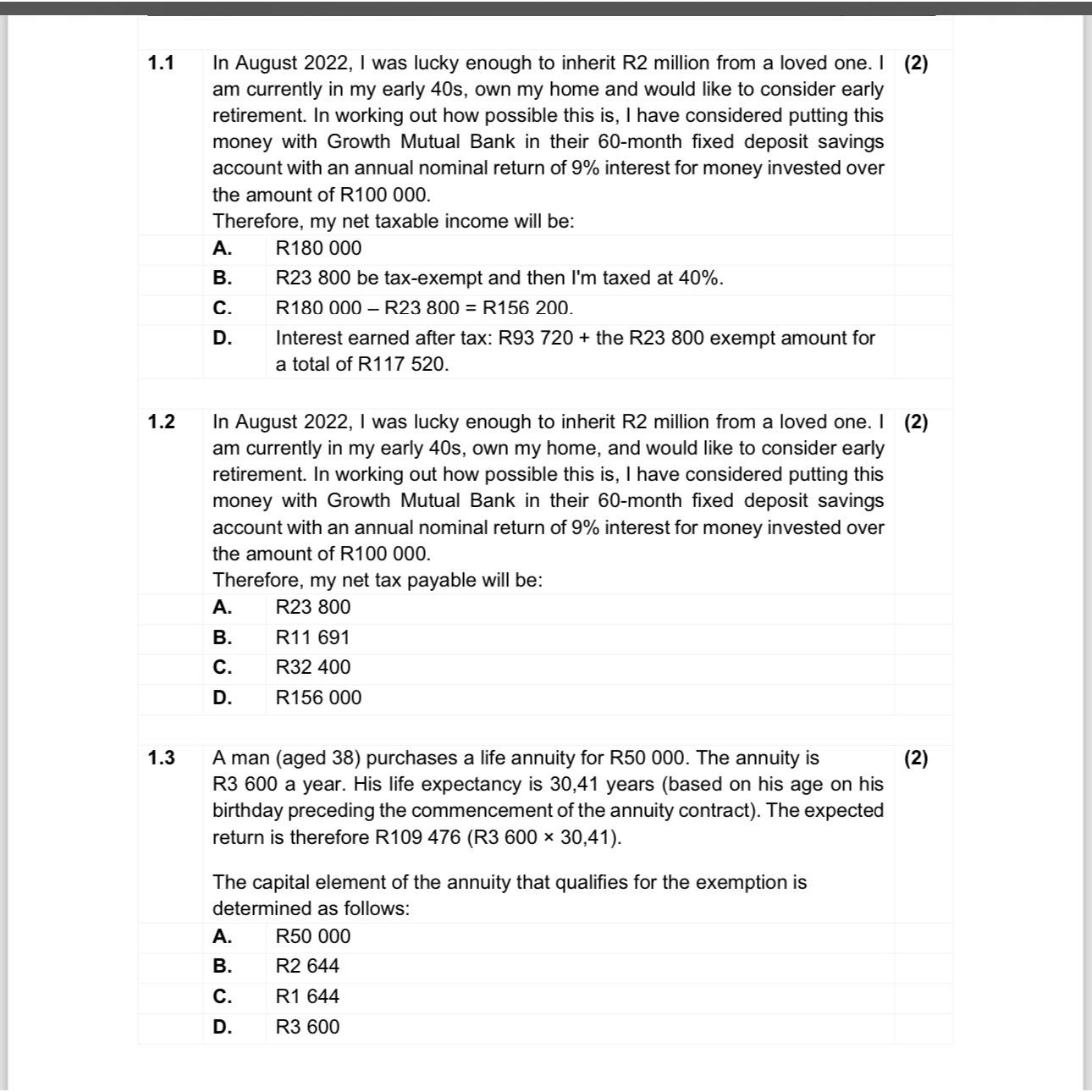

Question: 1 . 1 In August 2 0 2 2 , I was lucky enough to inherit R 2 million from a loved one. I (

In August I was lucky enough to inherit R million from a loved one. I

am currently in my early s own my home and would like to consider early retirement. In working out how possible this is I have considered putting this money with Growth Mutual Bank in their month fixed deposit savings account with an annual nominal return of interest for money invested over the amount of R

Therefore, my net taxable income will be:

A R

B R be taxexempt and then lm taxed at

C R

D Interest earned after tax: R the R exempt amount for a total of R

In August I was lucky enough to inherit R million from a loved one. I

am currently in my early s own my home, and would like to consider early retirement. In working out how possible this is I have considered putting this money with Growth Mutual Bank in their month fixed deposit savings account with an annual nominal return of interest for money invested over the amount of R

Therefore, my net tax payable will be:

A R

B R

C R

D R

A man aged purchases a life annuity for R The annuity is

R a year. His life expectancy is years based on his age on his birthday preceding the commencement of the annuity contract The expected return is therefore R

The capital element of the annuity that qualifies for the exemption is determined as follows:

A

B

C R

D R

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock