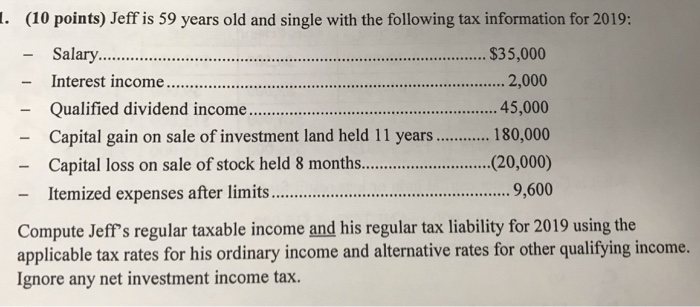

Question: 1. (10 points) Jeff is 59 years old and single with the following tax information for 2019: - Salary......... $35,000 - Interest income ..... .................

1. (10 points) Jeff is 59 years old and single with the following tax information for 2019: - Salary......... $35,000 - Interest income ..... ................. 2,000 - Qualified dividend income .... .............. 45,000 - Capital gain on sale of investment land held 11 years ............. 180,000 Capital loss on sale of stock held 8 months...........................(20,000) - Itemized expenses after limits ................ .................. 9,600 Compute Jeff's regular taxable income and his regular tax liability for 2019 using the applicable tax rates for his ordinary income and alternative rates for other qualifying income. Ignore any net investment income tax

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts